The United Kingdom boasts one of the largest gambling markets worldwide, generating gross gaming revenue (GGR) of £14.08 billion in the twelve months to March 2022. The country is set to remain a global leader in this respect. According to forecasts published by Technavio, the local gambling market’s size is poised to increase by $2.83 billion (£2.19 billion) by 2026, exhibiting a compound annual growth rate of 5.25%.

The United Kingdom boasts one of the largest gambling markets worldwide, generating gross gaming revenue (GGR) of £14.08 billion in the twelve months to March 2022. The country is set to remain a global leader in this respect. According to forecasts published by Technavio, the local gambling market’s size is poised to increase by $2.83 billion (£2.19 billion) by 2026, exhibiting a compound annual growth rate of 5.25%.

The leading market research firm estimates online gambling will be the biggest driver of the local market’s growth due to the comparatively few restrictions imposed on this sector. All forms of remote gambling are legal and regulated in the country, including online casino games, peer-to-peer poker, lotteries, bingo, and sports betting. However, market liberalisation is a double-edged sword, as it could lead to an increase in the rates of addiction and gambling-related harm.

In today’s report, we focus on gambling addiction in the UK and provide detailed statistical information about gambling participation rates, the prevalence of problem gambling among the population, and the socioeconomic impacts resulting from this issue. Also covered in the report are the measures the local government has adopted to curb gambling addiction in adults and juveniles. But first, let us look at a few facts and figures from the latest reporting period that will give you a better idea of the size of the UK gambling industry.

The UK Gambling Industry in Numbers (April 2021 – March 2022)

- Overall GGR of the UK gambling industry: £14.09 billion (£9.9 billion excluding lotteries, up 10.9% YoY)

- GGR of the UK online gambling industry: £6.44 billion (down 6.2% YoY)

- GGR from land-based gambling: £3.5 billion (up 110.5% YoY)

- GGR from land-based gambling machines: £1.8 billion (up 96.3% YoY)

- GGR of the best-performing segments: £3.9 billion from online casinos, £2.4 billion from online sportsbooks, £2.1 billion from land-based sportsbooks

- National Lottery donations to charities and good causes: £1.7 billion (down 0.5% YoY)

- Donations from other non-commercial lotteries: £417 million (up 3.8% YoY)

- Number of land-based gambling premises: 8,408 (down 2.5% YoY)

- Number of land-based bookmaking shops: 6,219 (down 3.8% YoY)

- Number of regulated gambling businesses: 2,419 (down 0.9% YoY)

- Number of regulated gambling activities: 3,339 (down 0.9% YoY)

- Number of active online gambling accounts: 31.88 million (up 7% YoY)

- Number of newly created online gambling accounts: 32.65 million (down 1% YoY)

- Combined balance of online gambling accounts: £910.5 million (up 1.9% YoY)

Source: UK Gambling Commission

Gambling Addiction and Problem Gambling

The differences between addiction and problem gambling are very nuanced. The UK Gambling Commission (UKGC), which regulates all forms of legal wagering in the country, defines problem gambling, or ludomania, as an activity that disrupts the day-to-day life of individuals and those around them to a certain degree. These disruptions can manifest themselves in various ways, including overspending, job loss, family problems, and a general disinterest in pursuing hobbies or other forms of recreation. Such individuals tend to deny or minimise the extent of their problem.

The differences between addiction and problem gambling are very nuanced. The UK Gambling Commission (UKGC), which regulates all forms of legal wagering in the country, defines problem gambling, or ludomania, as an activity that disrupts the day-to-day life of individuals and those around them to a certain degree. These disruptions can manifest themselves in various ways, including overspending, job loss, family problems, and a general disinterest in pursuing hobbies or other forms of recreation. Such individuals tend to deny or minimise the extent of their problem.

By contrast, gambling addiction is an impulse-control disorder in the clinical sense of the term. Addicts are well aware of their problem and the disruptions it causes, but they are no longer able to control themselves. Thus, they continue gambling despite the harm this causes to themselves and others. The UKGC relies on the so-called Problem Gambling Severity Index (PGSI) and the fourth edition of the Diagnostic and Statistical Manual of Mental Disorders (DSM) in its surveys on problem gambling.

Problem Gambling Severity Index (PGSI)

The PGSI comprises nine gambling-related questions survey participants must respond to, with each answer corresponding to a specific score as follows: never (0 points), sometimes (1 point), most of the time (2 points), and almost always (3 points). Combined scores range from zero to 27 points.

A person is classified as a problem gambler if they achieve a combined score of at least 8 points.

- A score of 0 points: non-problem gamblers

- A score of 1 or 2 points: a low level of gambling-related disruption

- Scores of 3 to 7 points: a moderate level of risk of gambling-related disruption

- Scores of 8 or more points: problem gamblers with possible compulsive behaviours

The Diagnostic and Statistical Manual of Mental Disorders (DSM)

The fourth edition of the DSM is implemented when conducting health surveys in three of the constituent countries of the UK (Wales, England, and Scotland). Used to diagnose pathological gambling, it comprises a different set of nine questions with four possible answers that range from ‘never’ to ‘very often’. Responses are rated with 0 or 1, with the total possible scores ranging from 0 to 10.

Gambling Participation Rates in the UK

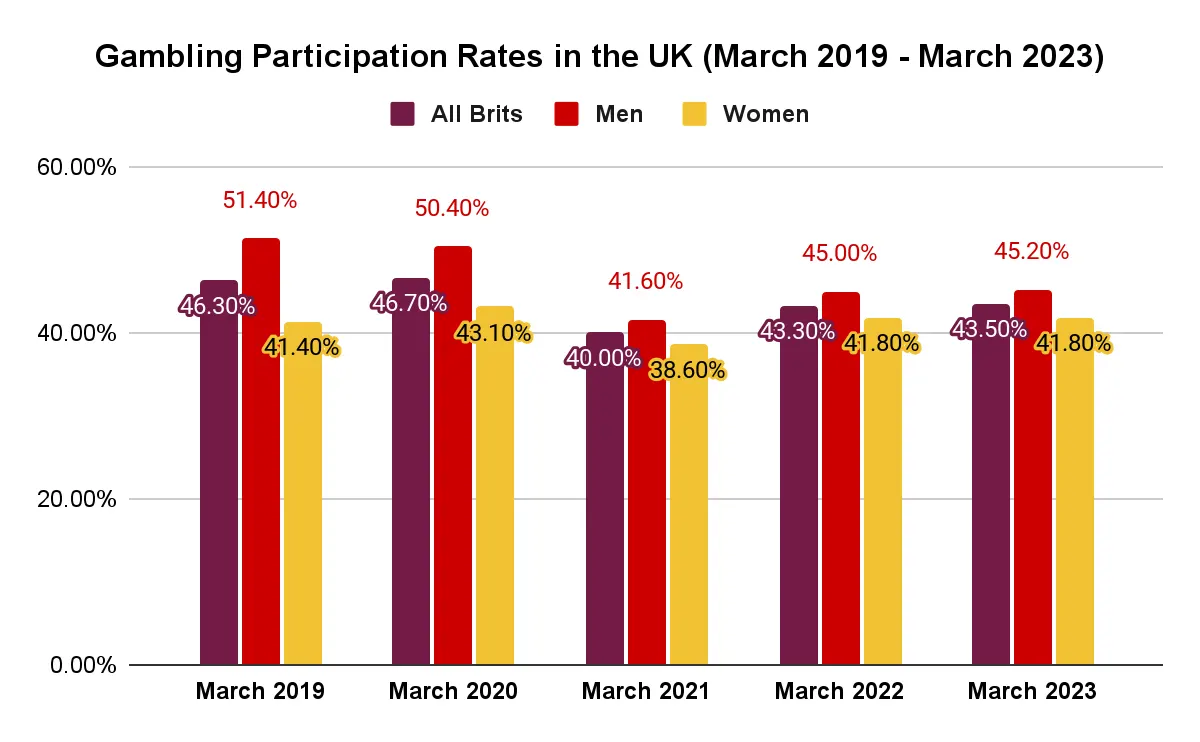

We decided first to look at the participation rates among the adult population to give you some context about the growing concerns related to problem gambling in the UK. Gambling is a popular recreational activity in the country, as is apparent from the results of the latest quarterly telephone survey carried out by Yonder Consulting on behalf of the UKGC. Participation rates remained statistically stable at around 44% in the twelve months to March 2023 compared to the previous year.

How Many Adult Brits Participate in Gambling Activities?

To arrive at the results below, Yonder Consulting interviewed 4,002 adult Brits, who were asked whether they had gambled over the previous four weeks. Here are the key findings of the survey, which took place in March 2023.

Source: Yonder Consulting/UK Gambling Commission

How Many Brits Gamble Actively?

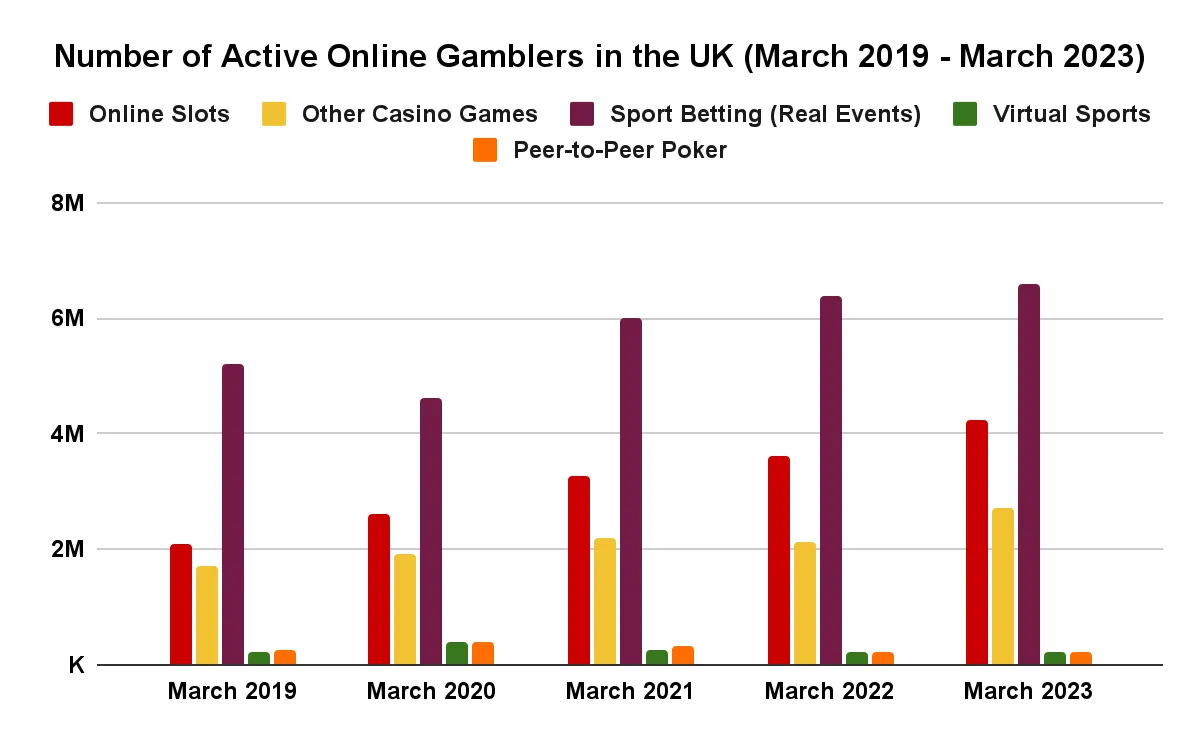

The UKGC collects data from the largest online gambling companies operating on the local market to determine the level of gambling activity among the population during each quarter. After unpacking this information, we established that the number of active slot players in the country has risen by 101.9% over the last four years, from 2.1 million in March 2019 to 4.2 million in March 2023.

As you can see on the graph below, similar increases can be observed across most of the other verticals. The number of active real-event sports bettors surged by approximately 1.4 million (26.7%), while that of people who actively played casino games other than slots grew by nearly 1 million (58.3%).

Source: Yonder Consulting/UK Gambling Commission

The only decrease occurred in peer-to-peer poker, as the number of active players dropped by 35,331 (-13.3%). We attribute these increases to the fact that much of this data was collected during the coronavirus pandemic, when society was placed in lockdown and people subsequently suffered from increased levels of boredom.

How Many Bets Do Brits Place per Month?

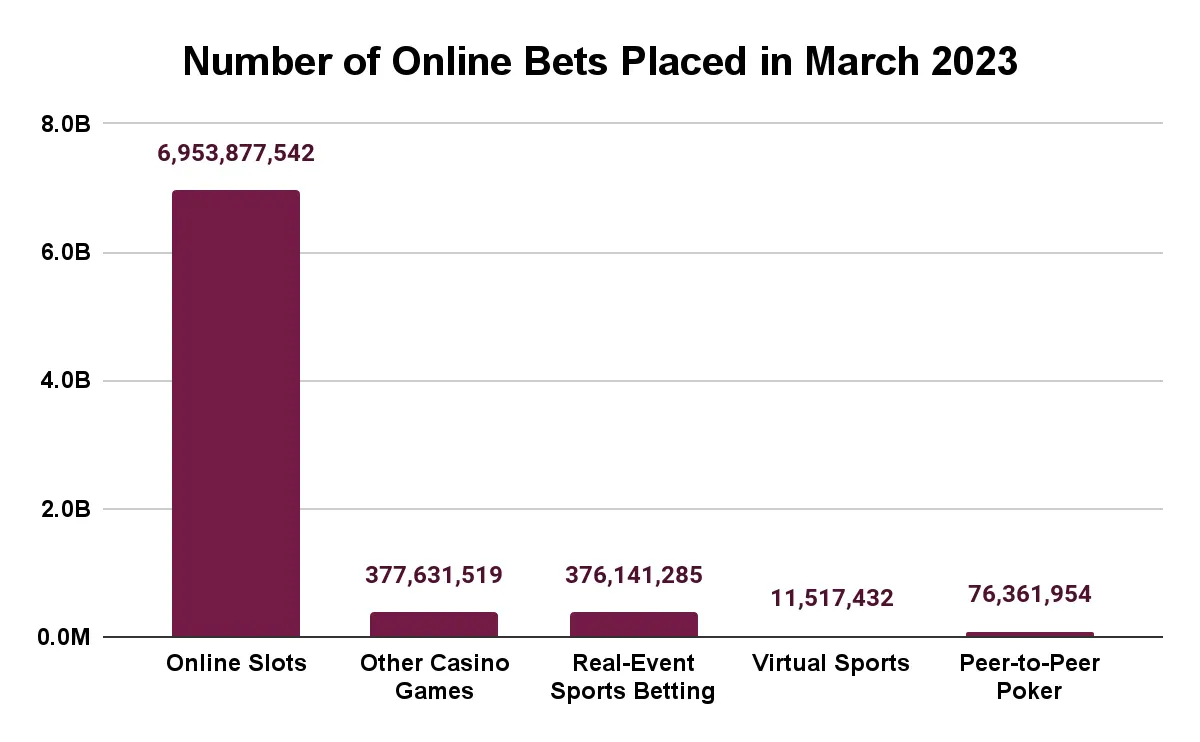

Looking at the latest figures published by the British gambling regulator, we see that local gamblers placed roughly 7.8 billion online wagers across all verticals in March 2023. This staggering number represents a 75.1% increase on the same month four years earlier, when 4.5 billion bets were placed in total.

Online slots attracted the most action in March 2023 with 6.95 billion bets, while other casino games (377.6 million), real-event sports betting (376.1 million), virtual sports (11.5 million), and peer-to-peer poker (76.4 million) trailed behind.

Source: Yonder Consulting/UK Gambling Commission

What Is the Average Length of Brits’ Online Gambling Sessions?

The average length of online gambling sessions has decreased from 26 minutes in March 2019 to 17 minutes in the same month this year. We consider this a positive trend, since a study published by Australian gambling researchers Alex Russell and Nerilee Hing in 2020 suggested longer betting sessions are associated with a higher risk of developing a gambling problem. The UKGC shares this opinion and considers increased session length a proxy for potential gambling-related harm. From this perspective, the reduction in session length among Brits is encouraging.

- March 2019: 26 minutes on average

- March 2020: 22 minutes on average (down 15.4% from March 2019)

- March 2021: 21 minutes on average (down 4.5% from March 2020)

- March 2022: 18 minutes on average (down 14.3% from March 2021)

- March 2023: 17 minutes on average (down 5.5% from March 2022)

Source: UK Gambling Commission

Online Sessions Over One Hour Have Increased in Number

On the downside, the number of individual sessions exceeding one hour has risen dramatically by 98.1% over the last four years, which the British gambling regulator views as troublesome. In March 2019, the sessions over one hour numbered approximately 1.6 million but increased by 353,584 in the same month the following year.

By March 2021, when the coronavirus pandemic was in full swing, the sessions exceeding one hour had surged to 2.7 million, ultimately reaching 3.1 million in March 2023. This means that nearly 6.3% of all gambling sessions during this month lasted in excess of an hour. You can see the untruncated numbers below.

- March 2019: 1,573,931 sessions over an hour

- March 2020: 1,927,515 (up 22.5% from the previous year)

- March 2021: 2,728,447 (up 41.6% YoY)

- March 2022: 2,775,805 (up 1.7% YoY)

- March 2023: 3,118,913 (up 12.4% YoY)

The Number of Betting-Machine Sessions Over an Hour Is Also on the Rise

The latest data pulled from the largest retail betting shops in Great Britain reveals that a similar upward trend can be observed regarding the duration of machine sessions. When we compared the figures for March 2019 and March 2023, we established that the number of machine sessions exceeding one hour has gone up by 41.4%.

The only significant decline occurred in the first quarter of 2021, but this is understandable considering England was experiencing its third nationwide lockdown at the time. Respectively, the recorded timeframe was considerably shorter than usual. Non-essential businesses, land-based gambling operators included, reopened in England in mid-2021, hence the dramatic decline in the number of machine sessions over an hour.

- March 2019: 160,694 machine sessions over one hour

- March 2020: 168,911 (up 5.1% YoY)

- January to March 2021: 1,216

- March 2022: 239,685 (up 41.9% YoY)

- March 2023: 227,235 (down 5.2% YoY)

Overall Number of Online Gambling Sessions

Increased engagement is another factor that boosts the risk of developing a gambling problem. In view of this, we find it unsettling that the overall number of online gambling sessions in March of this year is nearly 196% higher compared with the same month in 2019.

- March 2019: 16,832,862 sessions

- March 2020: 20,966,567 sessions (up 24.6% compared with March 2019)

- March 2021: 34,154,434 sessions (up 62.9%)

- March 2022: 41,809,091 sessions (up 22.4%)

- March 2023: 49,811,712 sessions (up 19.1%)

Source: UK Gambling Commission

Problem Gambling Prevalence in the UK

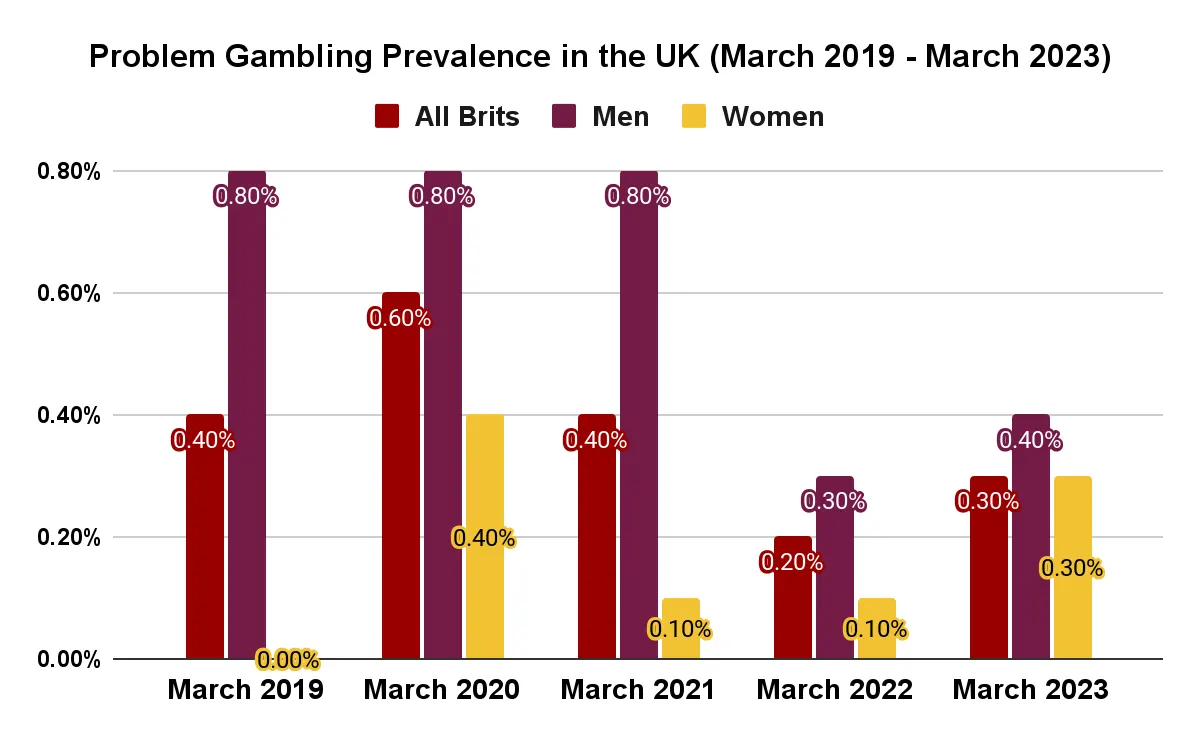

Now that we have provided context about the extent of gambling in the country, we shall proceed with data that is directly related to problem gambling. Despite the massive popularity of betting among Brits, the UK manages to maintain low problem-gambling levels largely thanks to the adequate regulations and strict consumer-protection policies that are in place.

Furthermore, the results of the Yonder Consulting survey we mentioned earlier indicate there is a downward trend in the percentage of problem gamblers. It was at its highest in the twelve months to March 2021, when 0.6% of Brits classified as problem gamblers. According to the latest data, this percentage has now dropped to 0.3%. The issue is more prevalent in males (0.4%) than females (0.3%), which makes perfect sense considering more men engage in such activities.

Source: Yonder Consulting/UK Gambling Commission

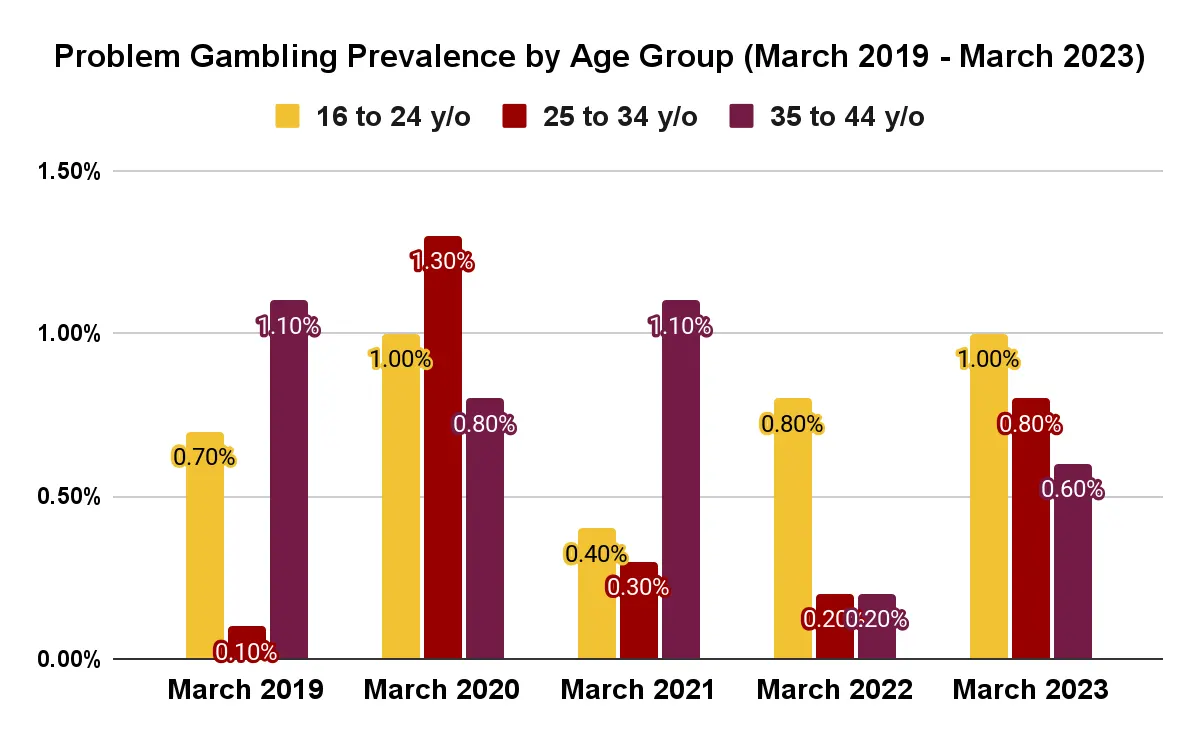

Prevalence of Problem Gambling by Age Group

The survey carried out by Yonder Consulting identified that young people are more prone to developing a problematic relationship with gambling. Individuals aged 16 to 24 years are at higher risk of becoming problem gamblers since their brains are still developing. The prefrontal cortex, the part of the brain that governs decision-making, prioritising, and planning, matures fully in the mid-20s.

Brits between the ages of 16 and 24 had the highest incidence of problem gambling in the year to March 2023, with 1% of people from this age group classified as problem gamblers. This condition is less common among adults aged 25 to 35 (0.8%) and 35 to 44 (0.6%). All three age groups exhibit a decline in problem-gambling rates compared with the twelve months to March 2019.

Source: Yonder Consulting/UK Gambling Commission

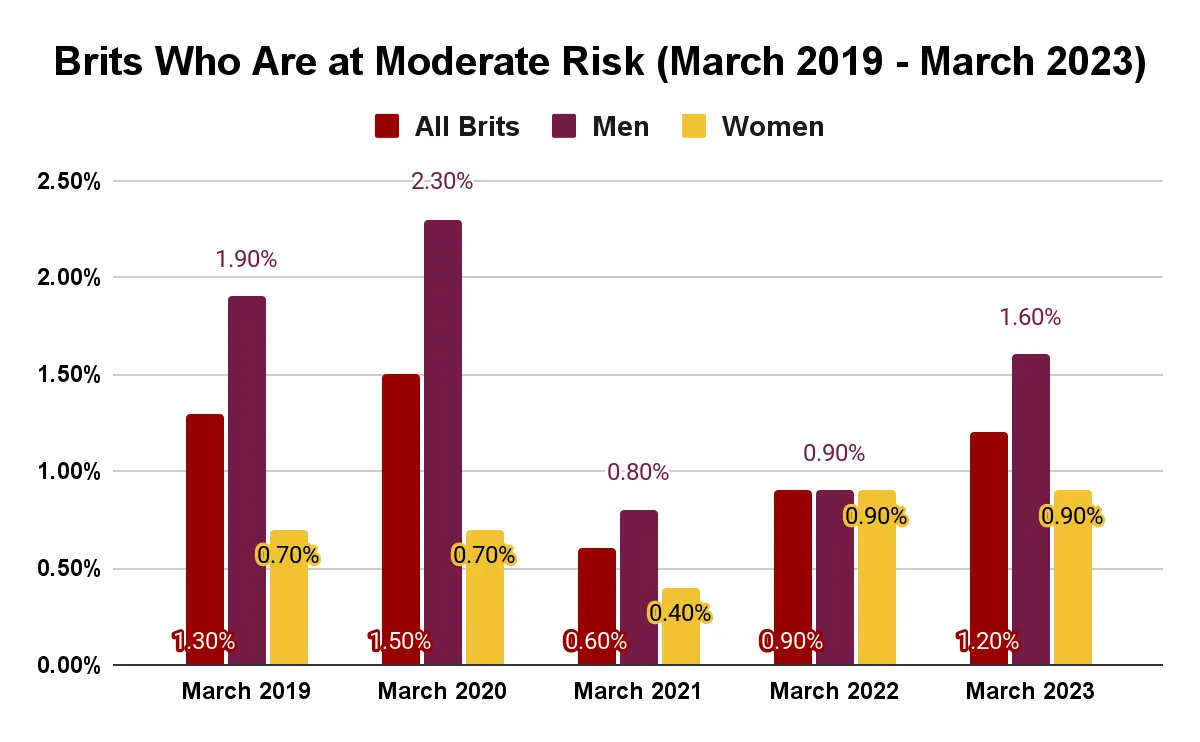

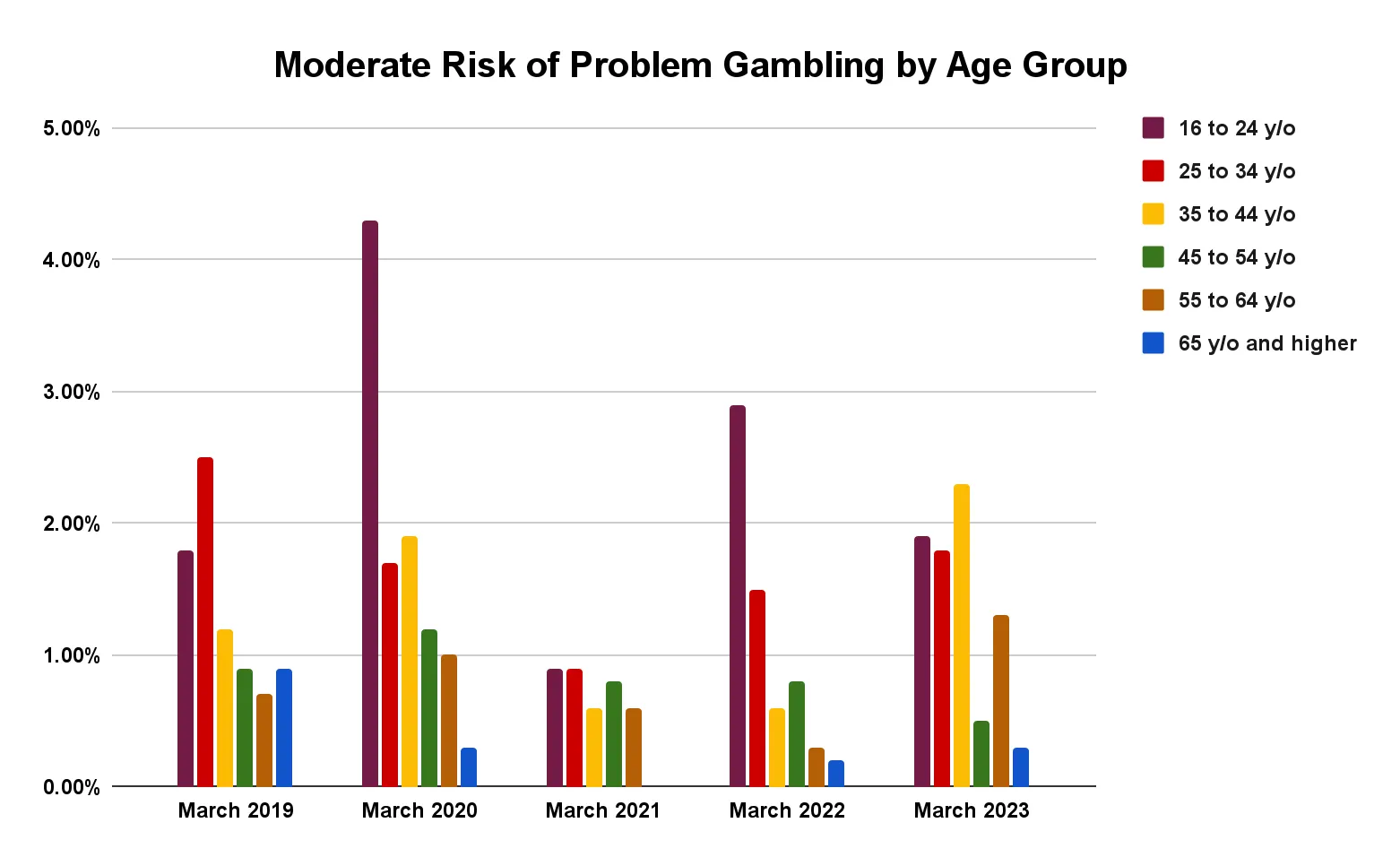

How Many Brits Are at Moderate Risk of Becoming Problem Gamblers?

On a more positive note, the percentage of residents who are at moderate risk of becoming problem gamblers has decreased in recent years, albeit very slightly. While the percentages largely remain statistically stable compared with the previous year, we can still observe a positive downward trend from the years to March 2019 and March 2020, when 1.3% and 1.5% of Brits were at moderate risk of developing a gambling problem.

Where gender is concerned, more men (1.6%) are at moderate risk than women (0.9%). The data show that the percentage of middle-aged people at moderate risk is the highest out of all age groups included in the Yonder Consulting survey. Individuals aged 65 or older are the least likely to become problem gamblers, with only 0.3%, but this is understandable considering they do not gamble as frequently.

Source: Yonder Consulting/UK Gambling Commission

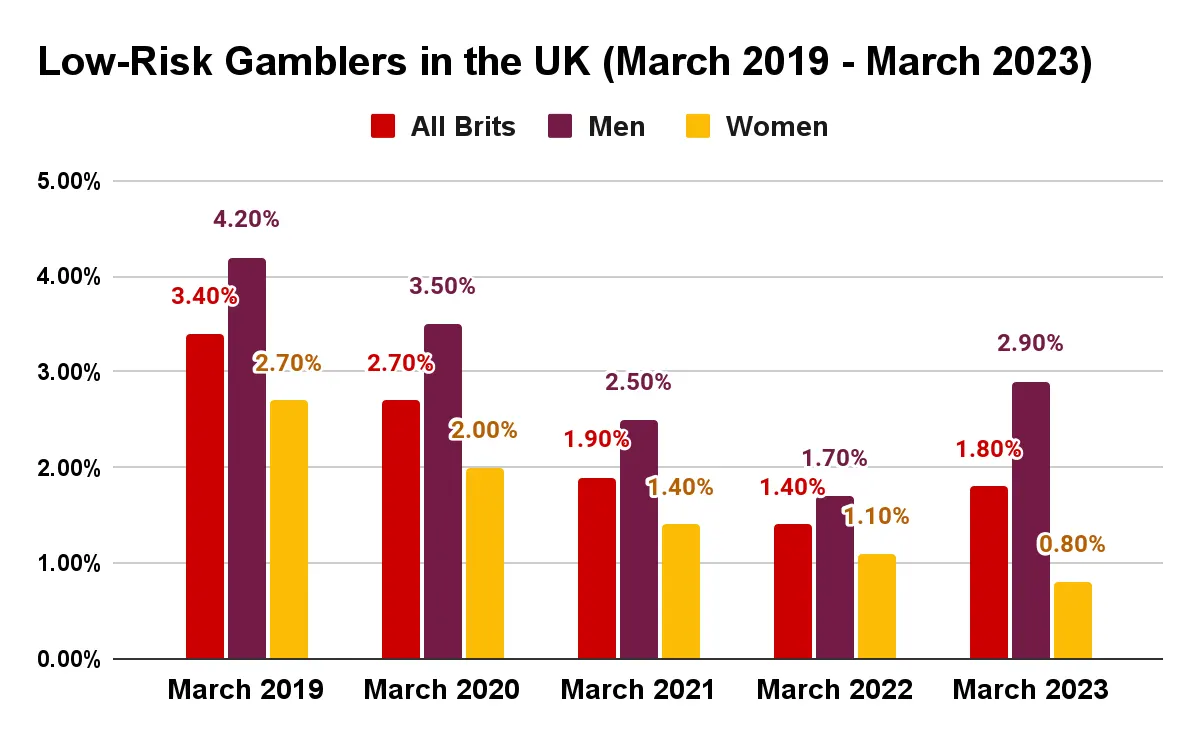

How Many Brits Are at Low Risk of Becoming Problem Gamblers?

According to the Problem Gambling Severity Index, the low-risk category consists of individuals who experience very few gambling-related issues without identified negative consequences in their day-to-day lives. However, such people should not be mistaken for non-problem gamblers, who comprise the largest portion of the population.

The percentage of low-risk gamblers has decreased almost two-fold since March 2019, dropping from 3.4% to 1.8% in the same month this year. Low-risk gambling is more common among males (2.9%) than females (0.8%).

In terms of age, people aged 25 to 34 and 35 to 44 account for the largest portion of low-risk gamblers (2.3% for each group). Approximately 1.9% of all low-risk gamblers are young adults aged between 16 and 24 years.

Source: Yonder Consulting/UK Gambling Commission

Trends among British Gamblers

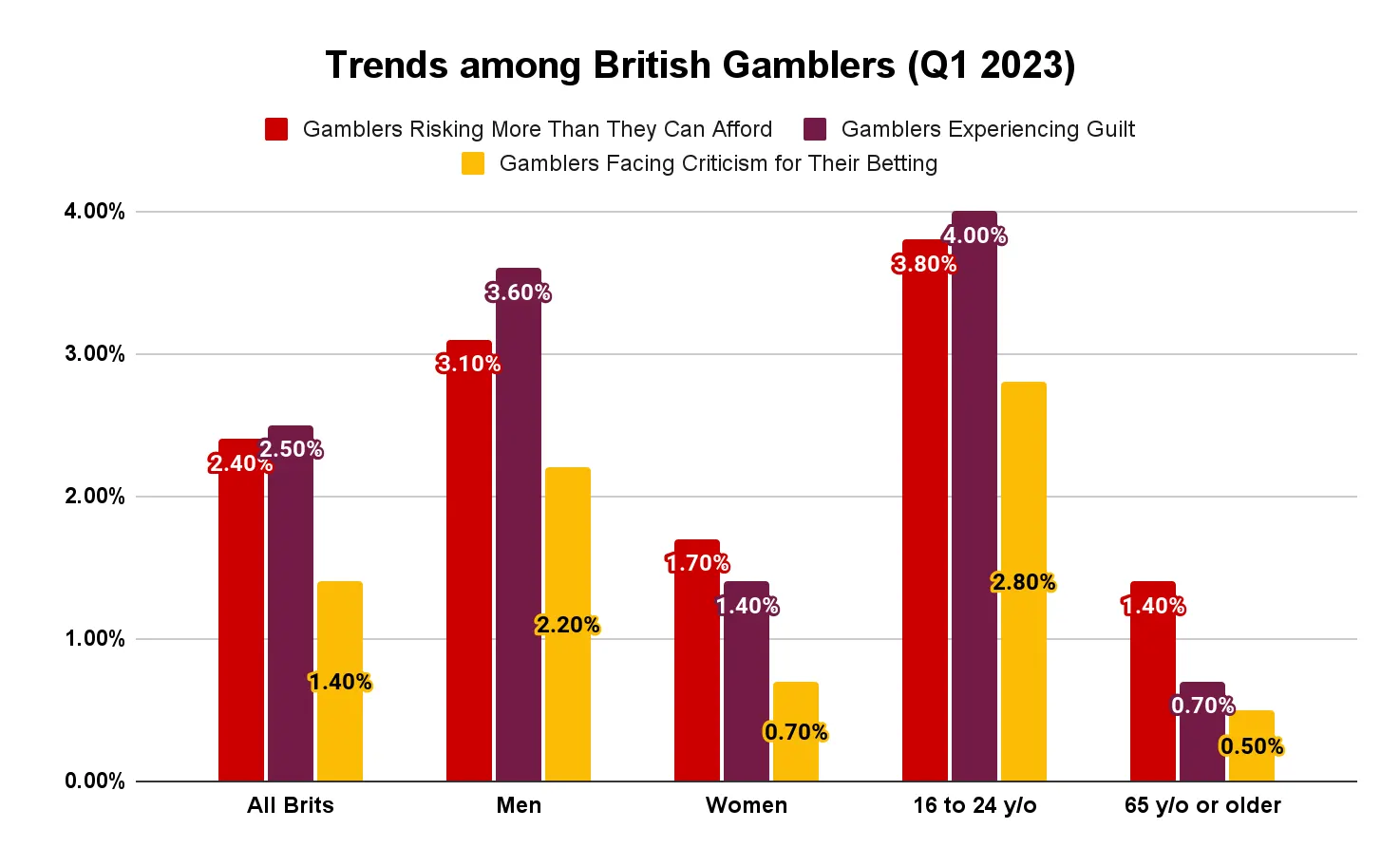

The shorter version of the PGSI screen test consists of three questions only, with answers ranging from ‘never’ to ‘almost always’. This version is used for Yonder Consulting survey participants who have gambled one or more times during the past year.

Such gamblers are asked whether they have wagered more money than they could afford to lose, whether people have criticised them for their gambling, and whether they have felt guilt about their betting. UKGC data collected from Q1 2016 to Q1 2023 provide valuable insights into the answers.

Gamblers Risking More Money Than They Can Afford to Lose

Gamblers Facing Criticism for Their Wagering

Gamblers Experiencing Guilt Because of Their Betting

Source: Yonder Consulting/UK Gambling Commission

Contributions for Problem Gambling Prevention, Treatment, and Research

All licensed gambling companies operating on the UK market are required to contribute a portion of their annual revenue to organisations that provide free counselling, support, and treatment to residents who suffer from problem gambling and addictions. Some of the donated funds go towards prevention and research.

All licensed gambling companies operating on the UK market are required to contribute a portion of their annual revenue to organisations that provide free counselling, support, and treatment to residents who suffer from problem gambling and addictions. Some of the donated funds go towards prevention and research.

UKGC-Approved Organisations for Treatment, Prevention, and Research

The UKGC has 29 organisations on its list of approved entities at the time of publication. Each year, licensed operators must channel their donations to at least one of these organisations for free counselling and support. Contributions made to entities that provide paid services do not count.

- Non-profit organisations: 18

- Private companies: 3

- University research: 3

- Community-interest companies: 5

How Much Money Goes Towards Problem Gambling Treatment, Prevention, and Research?

Official data published by the British gambling regulator reveal that licensed operators collectively contributed approximately £39.7 million from April 2021 to March 2022. The biggest inflow of donations occurred between January and March 2022, when the approved organisations collected around £25.6 million in contributions. GambleAware raised the highest amount during these twelve months, with £34.7 million in donations, or 87.3% of the overall contributions made.

Problem Gambling Donations per Quarter

- April to June 2021: £3,128,298

- July to September 2021: £7,066,574 (up 125.9% from Q1)

- October to December 2021: £4,287,453 (down 39.3% from Q2)

- January to March 2022: £25,252,433 (up 489% from Q3)

All in all, donations directed to approved organisations rose by 707.2% from Q1 to Q4, which is definitely a move in the right direction where the country’s battle against gambling harm is concerned. Below, you can track which recipients attracted the most contributions during this period.

How Much Money Do Problem Gambling Organisations Collect?

- #1. GambleAware: £34,702,824 from April 2021 to March 2022

- #2. GamCare: £1,826,285

- #3. Young Gamers & Gamblers Education Trust: £1,417,136

- #4. Gordon Moody Association: £700,654

- #5. EPIC Risk Management: £484,284

- #6. Leon House Health and Wellbeing: £245,400

- #7. Betknowmore UK: £188,850

- #8. Deal Me Out: £92,850

- #9. ESG Corporate Community Interest Company: £34,884

- #10. Betblocker: £21,394

How Many Brits Seek Assistance for Problem Gambling?

GambleAware, the recipient of the largest share of contributions from gambling operators, commissioned a survey with the data analytics company YouGov to establish how many Brits seek treatment and support for gambling-related problems. The study was conducted in November 2021 and involved a nationally representative sample of 4,000 individuals.

GambleAware, the recipient of the largest share of contributions from gambling operators, commissioned a survey with the data analytics company YouGov to establish how many Brits seek treatment and support for gambling-related problems. The study was conducted in November 2021 and involved a nationally representative sample of 4,000 individuals.

According to the findings, 15% of British gamblers with a PGSI score of 1+ sought professional treatment over the year prior to being surveyed. For clarification, the full version of the PGSI screen test was used to determine whether the surveyed participants qualified as problem gamblers. A PGSI score of 1 or 2 points indicates a low level of gambling-related problems, while scores equal to or exceeding 8 points correspond to gambling with severe negative consequences.

| Usage of Professional Treatment among PGSI 1+ Gamblers (2019-2021) | |||

|---|---|---|---|

| PGSI Score | 2019 | 2020 | 2021 |

| All 1+ Gamblers | 12.00% | 14.00% | 15.00% |

| 1 – 2 Scores | 2.00% | 2.00% | 2.00% |

| 3 – 7 Scores | 9.00% | 9.00% | 6.00% |

| 8+ Scores | 43.00% | 53.00% | 55.00% |

Approximately 14% of all PGSI 1+ gamblers reported seeking advice from friends, relatives, or support groups. This percentage is significantly greater among high-risk gamblers with scores exceeding 8 points. As much as 80% of all surveyed PGSI 1+ gamblers did not seek treatment or support.

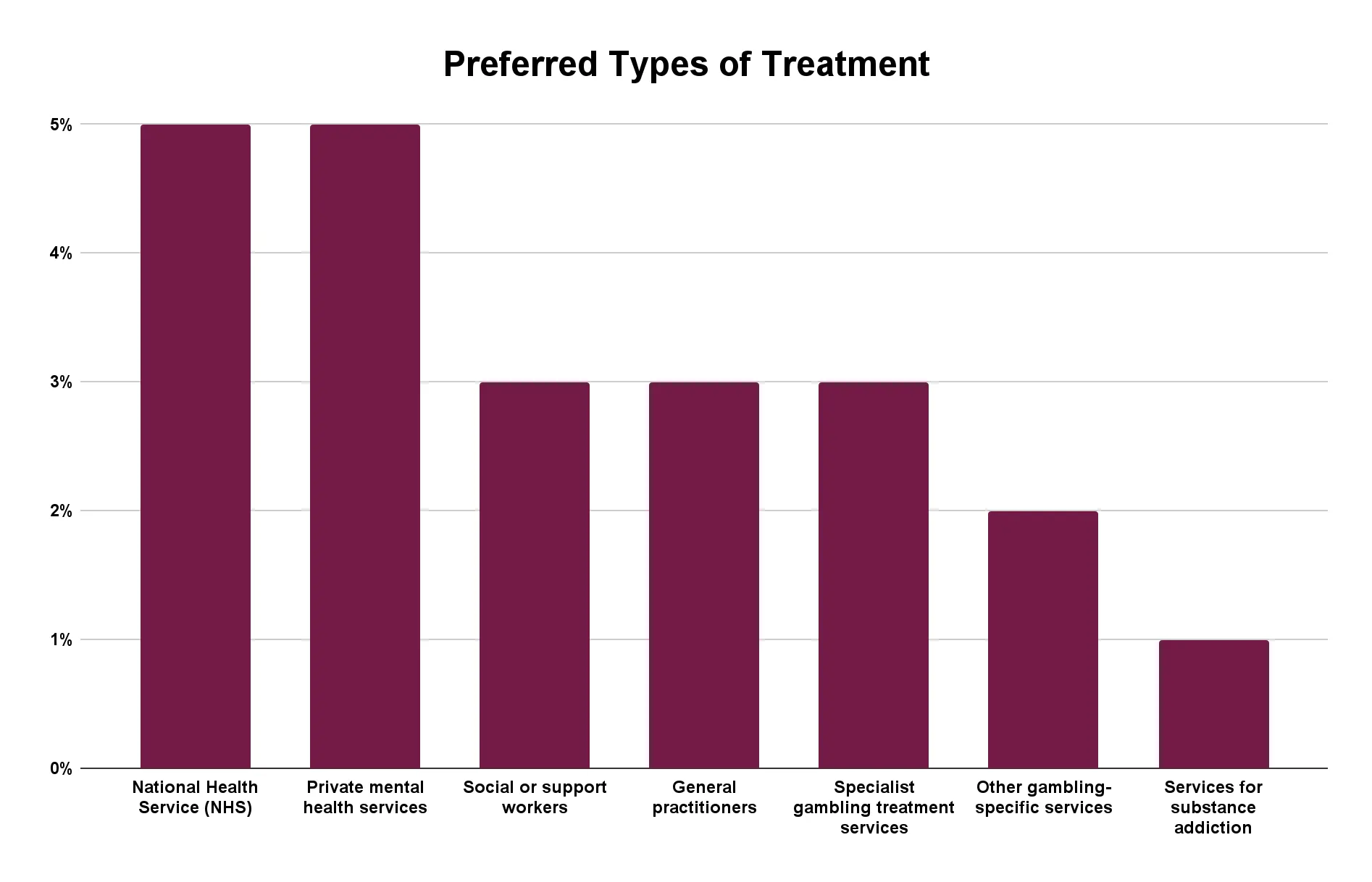

Preferred Types of Treatment and Support among Problem Gamblers in the UK

Most PGSI 1+ gamblers in the UK prefer to use person-to-person or online mental-health services when seeking treatment. Some lean towards private counsellors and therapists, while others rely on the National Health Service (NHS), general practitioners, social workers, and other addiction services.

Source: YouGov/GambleAware

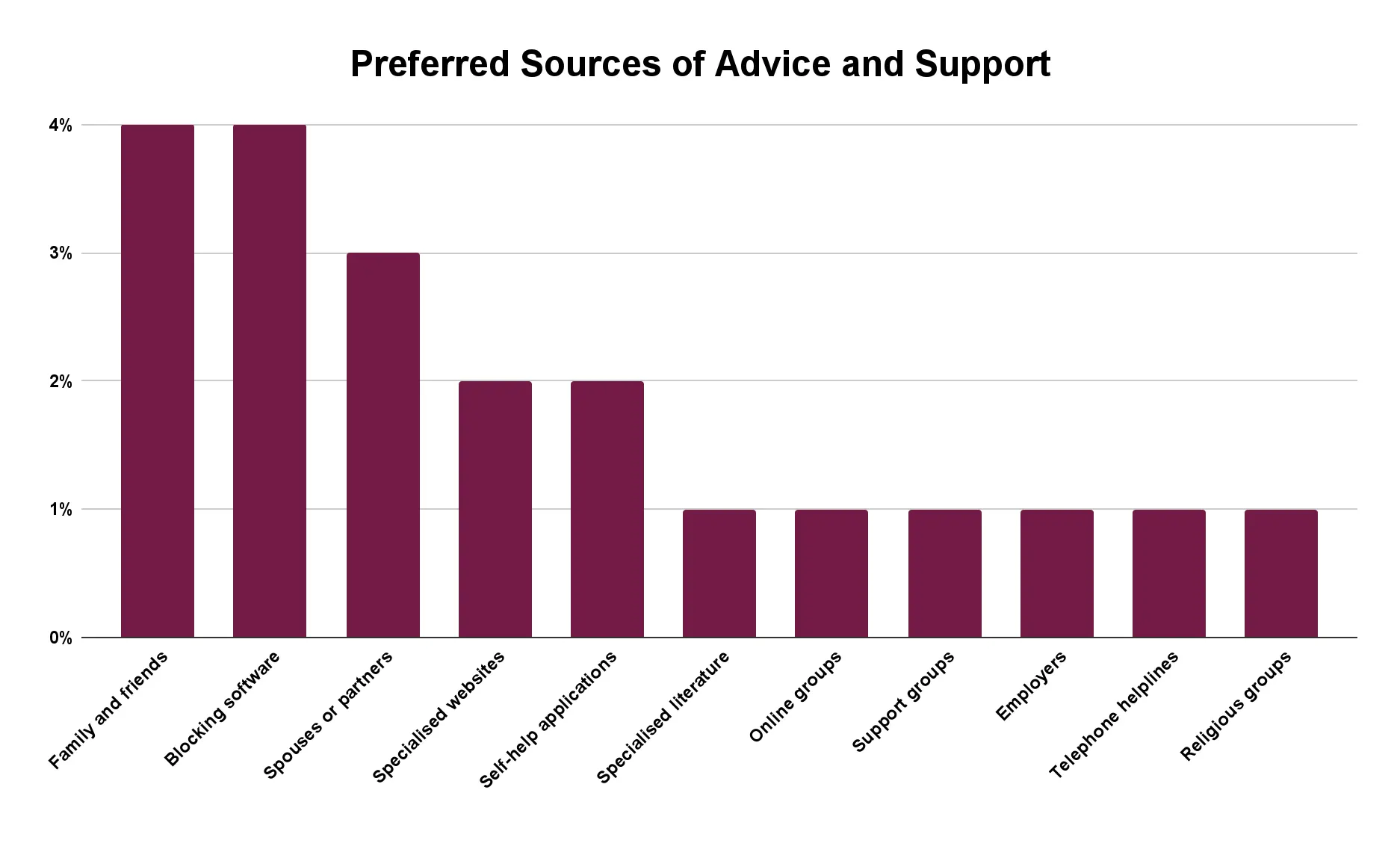

Preferred Sources of Support and Advice among Problem Gamblers in the UK

Friends and family are the most common source of support or advice, followed by self-exclusion, spouses or partners, specialised websites, self-help applications or tools, and specialised literature, among others. These are usually the first steps taken by individuals who suffer from problem gambling. Most people resort to professional counsellors only if these steps prove unsuccessful.

Source: YouGov/GambleAware

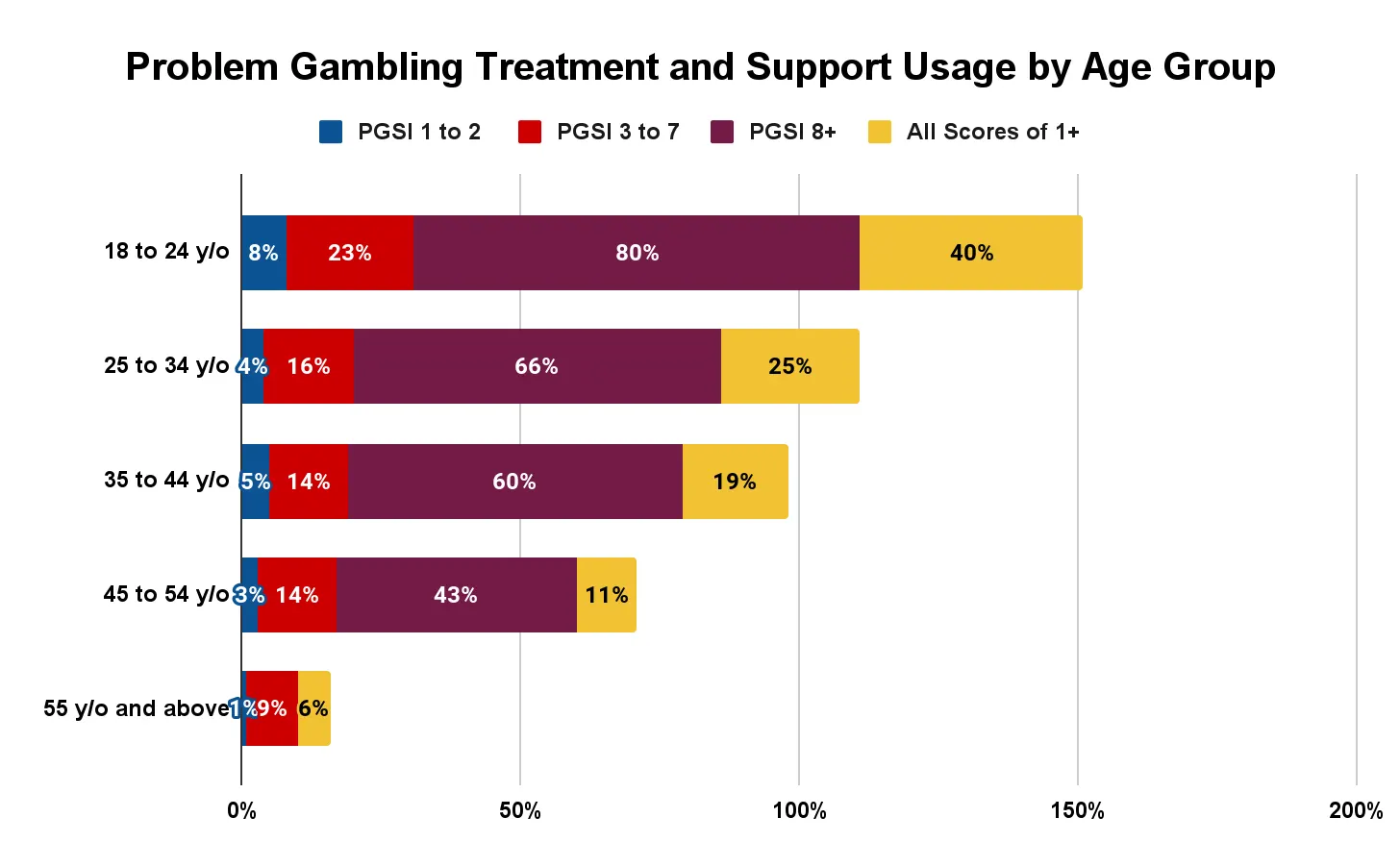

Problem Gambling Treatment and Support by Age Group

Younger adults between 18 and 24 years are more likely to seek assistance and support compared with their older counterparts, especially if they have achieved higher scores on the PGSI tests. This tendency is particularly noticeable among gamblers from this age group with PGSI scores of 8 points or higher. As you can see below, individuals aged 55 and above are the least likely to seek professional treatment or counselling.

Source: YouGov/GambleAware

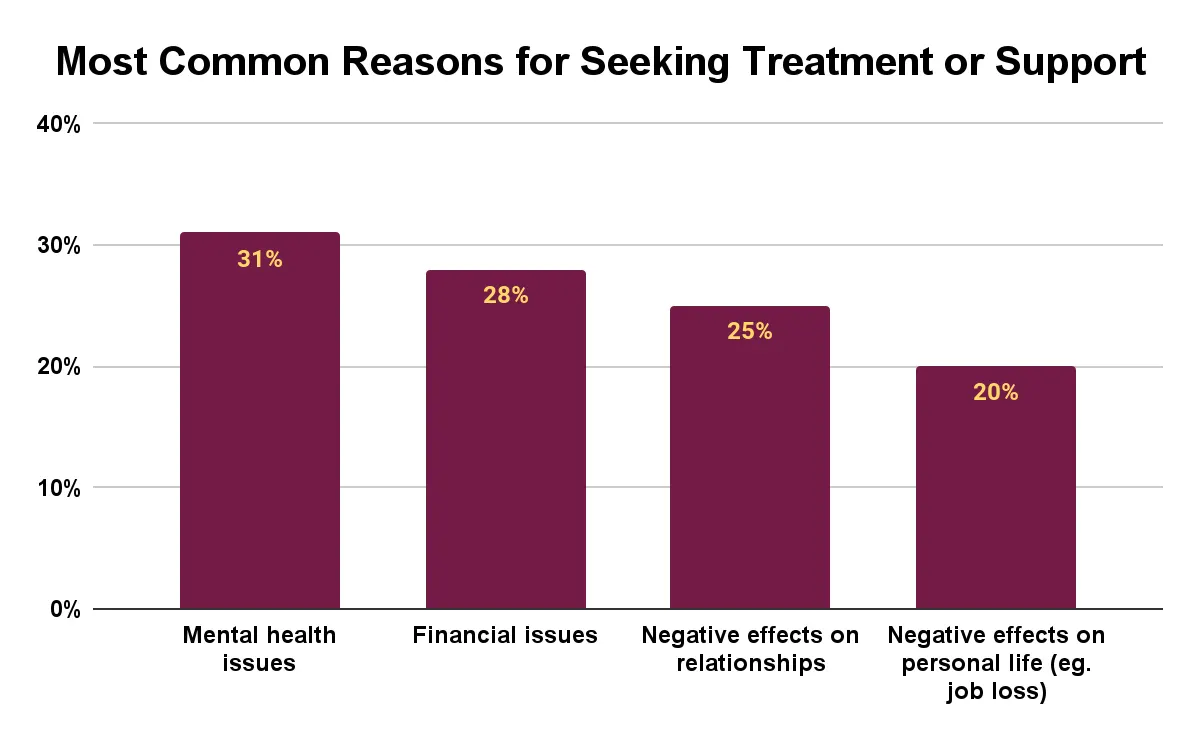

Reasons for Seeking Treatment

According to data collected by YouGov, mental-health issues such as anxiety are the most common reason for seeking assistance among gamblers with a PGSI of 1+. Approximately one in three gamblers sought treatment or counselling due to feeling anxious or worried as a result of their wagering. Financial issues or changed financial circumstances ranked as the second most widespread reason in 2021, followed by the negative impacts of gambling on relationships and personal life.

Source: YouGov/GambleAware

Factors Leading to Heightened Risk of Developing Gambling Problems

Problem Gamblers Seeking Long-Term Support

Relapses are common among people who struggle with addictions, and problem gamblers are no exception. A relapse occurs when a person returns to excessive gambling after a period of abstinence from betting. Because of this, most individuals struggling with this condition require long-term assistance and counselling.

Relapses are common among people who struggle with addictions, and problem gamblers are no exception. A relapse occurs when a person returns to excessive gambling after a period of abstinence from betting. Because of this, most individuals struggling with this condition require long-term assistance and counselling.

Many problem gamblers who participated in the 2021 YouGov survey reported they had sought treatment and support more than once. Several have resorted to using different forms of assistance, which shows this problem requires a holistic approach. What works for one person may prove ineffective for another, and vice versa.

More than half of the gamblers (56%) who admitted to using mental-health services said they had done so before. Similar tendencies can be observed among people who resorted to other forms of assistance, such as self-help apps (52%) or seeing their general practitioner (44%). Self-exclusion appears to be the most effective method of conquering problem gambling, as 65% of the gamblers who voluntarily excluded themselves claimed this was their first time doing so.

| Gamblers Who Have Sought Help More Than Once | |||

|---|---|---|---|

| Form of Treatment or Support | Gamblers Who Had Used the Service Before | First-Time Users | Don’t Know |

| Private Mental Health Services | 56.00% | 31.00% | 13.00% |

| Self-Help Tools | 52.00% | 37.00% | 11.00% |

| Seeing a General Practitioner | 44.00% | 43.00% | 14.00% |

| Specialist Treatment Services for Gambling | 43.00% | 45.00% | 12.00% |

| National Health Service (NHS) | 43.00% | 41.00% | 16.00% |

| Support from Friends or Relatives | 39.00% | 53.00% | 8.00% |

| Support from Spouse or Partner | 38.00% | 50.00% | 12.00% |

| Specialised Websites (GamCare, GambleAware) | 35.00% | 48.00% | 17.00% |

| Help from Social Workers | 31.00% | 44.00% | 24.00% |

| Self-Exclusion | 29.00% | 65.00% | 6.00% |

Source: YouGov/GambleAware

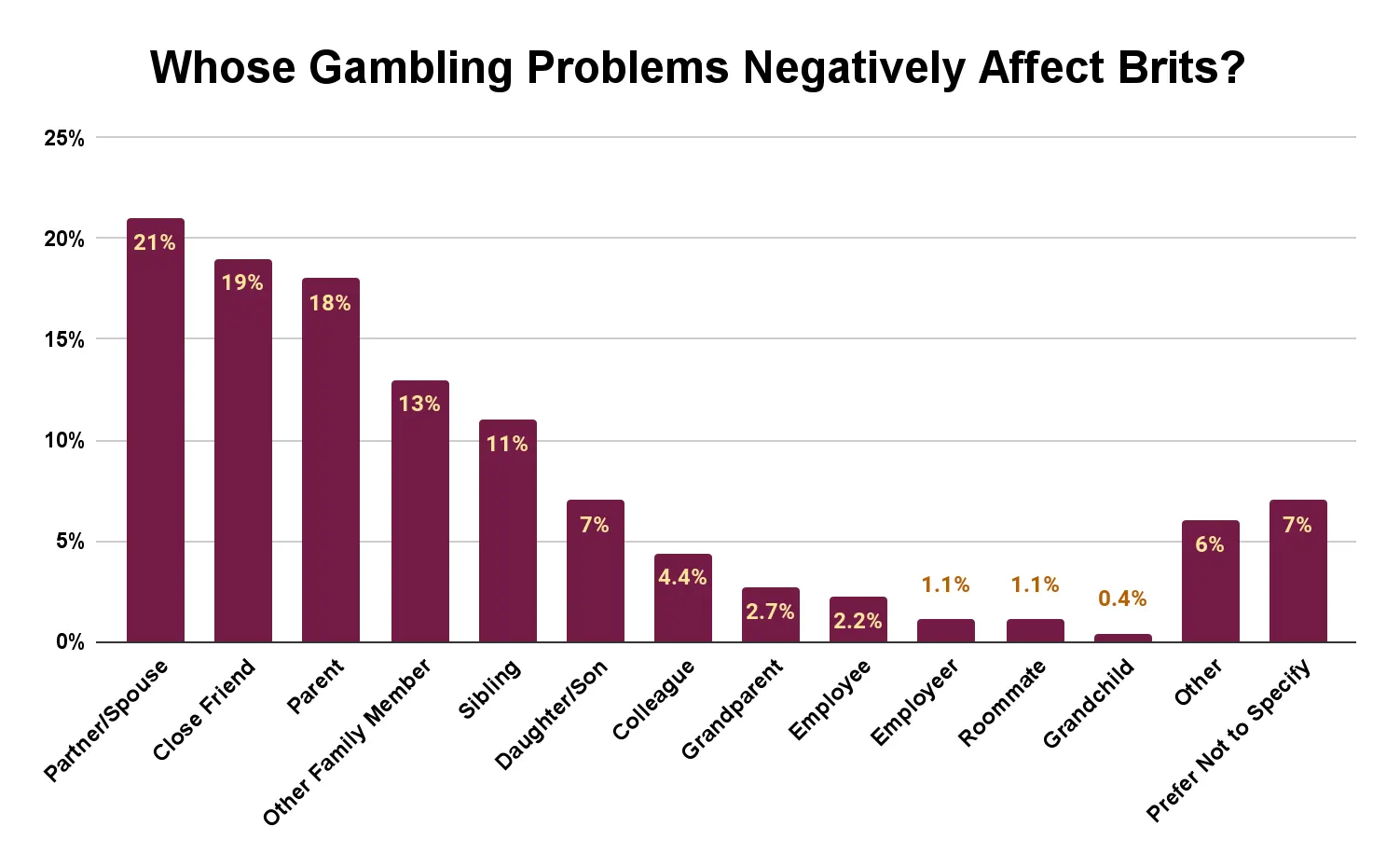

Impact of Problem Gambling on Others

Problem gambling can have pronounced negative effects not only on gamblers themselves but also on those around them, including friends, relatives, and colleagues. According to YouGov, approximately 3.34 million adults (6%) in the UK have experienced the negative consequences of someone else’s gambling problem.

Problem gambling can have pronounced negative effects not only on gamblers themselves but also on those around them, including friends, relatives, and colleagues. According to YouGov, approximately 3.34 million adults (6%) in the UK have experienced the negative consequences of someone else’s gambling problem.

Over half of the affected individuals (53%) suffered from the excessive gambling of a close family member such as a spouse, parent, or sibling. One in five said they experienced problems as a result of the gambling of a roommate or friend.

Source: YouGov/GambleAware

Most victims of another person’s problem gambling are female, which makes sense considering the majority of people who suffer from this condition are male. The bulk of relationships in the country are heterosexual, which results in more female spouses being affected by their partners’ gambling problems.

How Severe Is the Impact of Problem Gambling on Others?

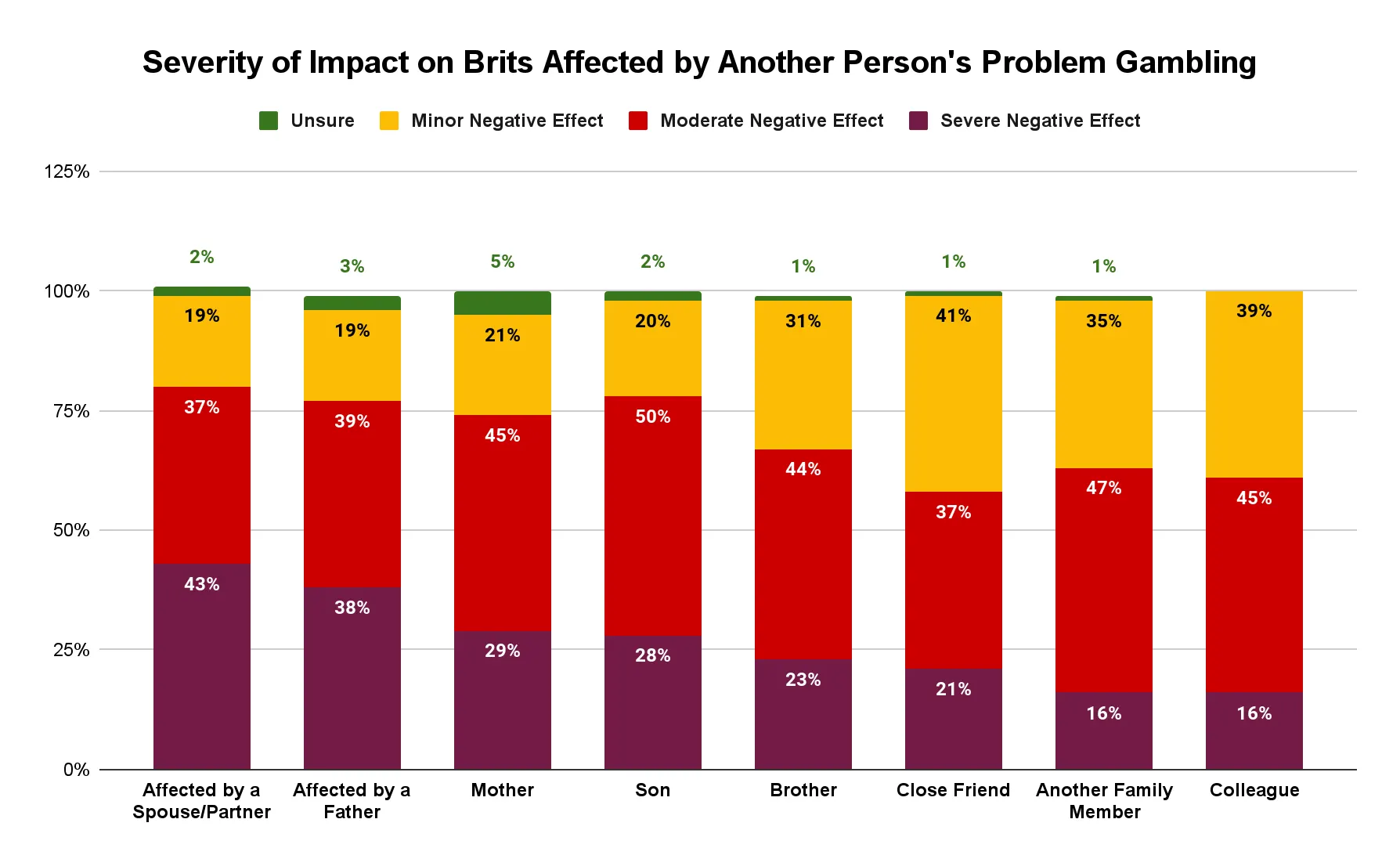

Most Brits who were affected by the excessive gambling of a spouse or partner (43%) describe the impact as ‘severe’. We attribute this to the intimate nature of the relationships between spouses. Severe negative effects are also frequently observed among those affected by the gambling of their parents, children, or siblings.

Source: YouGov/GambleAware

Types of Negative Impacts Problem Gambling Has on Others

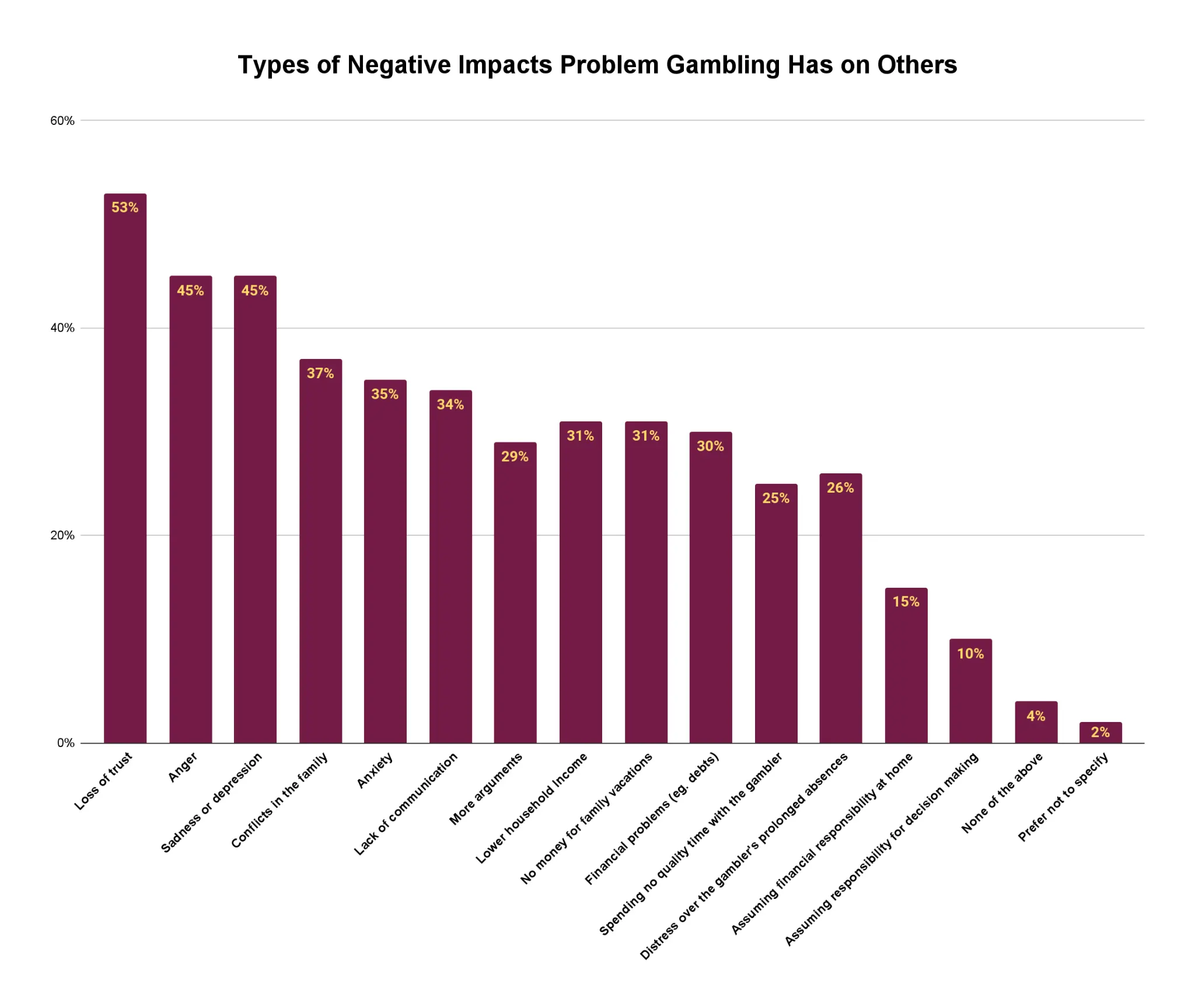

It is important to understand that excessive gambling can have profound negative effects on both gamblers and the people around them. While these negative impacts are far-reaching, the majority of the individuals affected by someone else’s problem gambling report this behaviour has resulted in the loss of trust (53%), followed by angry feelings towards the gambler (45%), and depression or sadness (45%).

Source: YouGov/GambleAware

How Common Is Self-Exclusion among British Gamblers?

The nationwide self-exclusion scheme GAMSTOP reported 84,000 Brits voluntarily blocked themselves from online gambling participation in 2022. This number is the highest the organisation has seen to date and represents a 6% increase on the previous year. Here are some other interesting facts regarding self-exclusion in the UK.

Source: GAMSTOP

Gender and Age of GAMSTOP Users

While problem gambling does not discriminate based on race, age, or gender, Sonnet Advisory and Impact analysed the demographic profile of those who use the scheme to determine which groups resort to self-exclusion most often. To this end, the consulting firm was commissioned by GAMSTOP to conduct a survey involving 51,833 users.

Sonnet established that people aged 35 to 44 years comprise the largest portion of gamblers (30%) registered with the scheme in 2021. Self-exclusion is less common among gamblers from the 25-34 and 45-54 age groups, which represented 23% and 25% of the entire user base. As for gender, the percentage of self-excluded females was the highest among those aged 45 to 54 (29%). By contrast, the largest group of self-excluded males comprised gamblers aged 35 to 44.

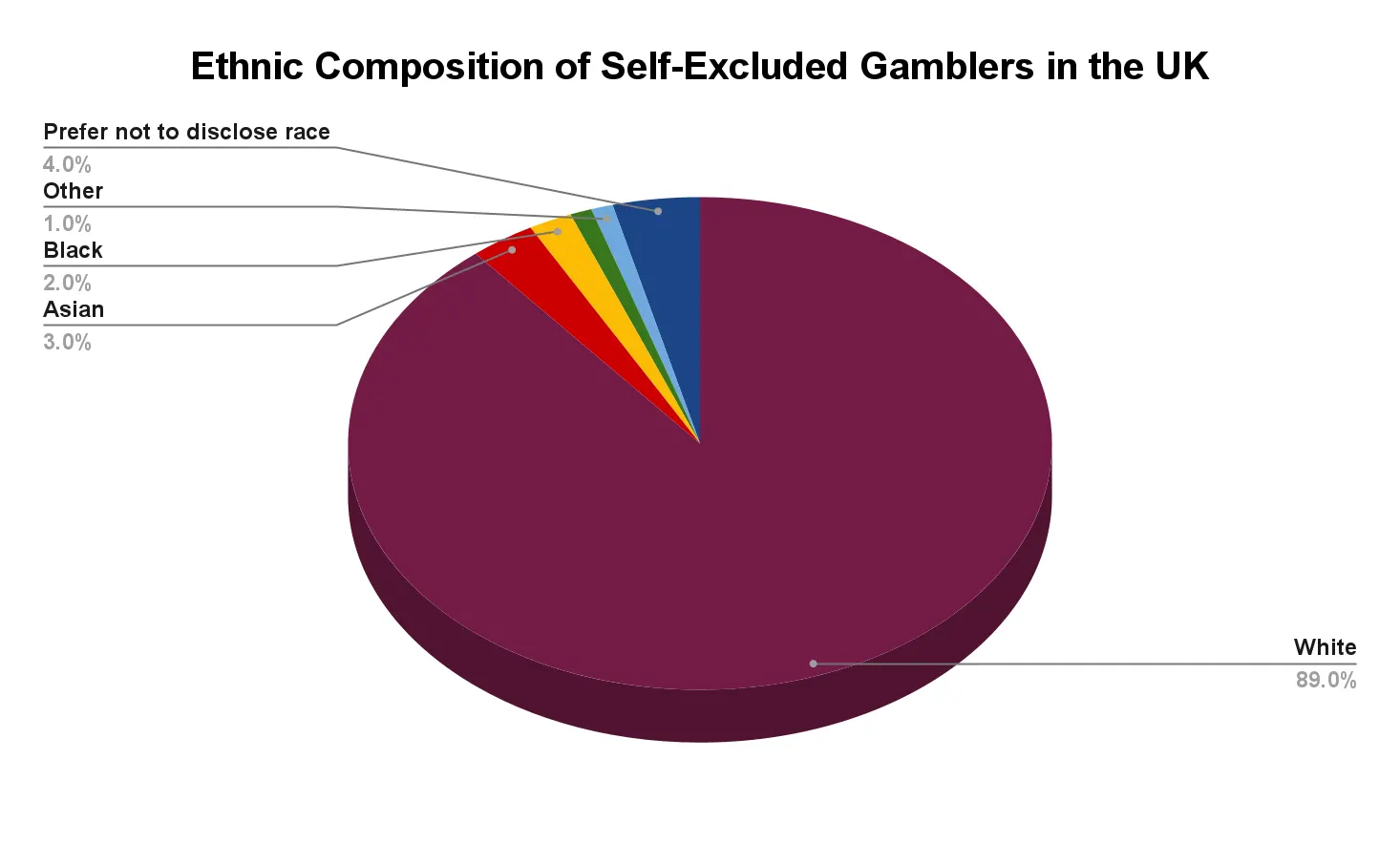

Ethnicity of Self-Excluded Gamblers

In terms of ethnicity, most self-excluded gamblers, or 89%, were white compared with Asian (3%), Black (2%), and multiracial (1%). These results are inconsistent with the findings of the YouGov study that suggests BAME residents are more likely to suffer from gambling-related problems. The discrepancies may be due to the fact that YouGov used the PGSI scale to identify people classified as problem gamblers, whereas the self-exclusion scheme is accessible to all. It may be implemented by a broader population even if some self-excluded individuals do not satisfy the criteria adopted in the YouGov analysis.

Source: Sonnet Advisory and Impact

Income and Household Size of Self-Excluded Gamblers

The Sonnet Advisory and Impact survey indicates that most gamblers who voluntarily exclude themselves from gambling belong to the higher-income bracket, with 29% of all self-exclusions coming from people who earn more than £48,000 annually.

As much as 63% of the self-exclusions occur in households without children. The majority of self-excluded Brits either live by themselves (23%) or with one other adult. Single-parent households represent 9% of the self-exclusions.

Most voluntary bans occurred among persons who were either fully or partially employed (75%) compared with the unemployed gamblers, who accounted for only 4% of the GAMSTOP exclusions. Most users of the scheme reside in privately rented housing. Only 20% of the excluded were residents of public-housing properties.

Length of Self-Exclusion via GAMSTOP

Most Brits who resort to the GAMSTOP scheme opt for the longest possible period of temporary self-exclusion, which is five years. As much as 71% of the self-excluded gamblers have opted for this period. Five years is the preferred exclusion length for 58% of the scheme’s users aged 18 to 24, as opposed to 74% of those aged 65 to 74. Mostly males (73%) prefer the five-year period compared with females (67%).

Nearly half of all excluded Brits (48%) say they learned about GAMSTOP via an online search, which shows most were unaware of the scheme’s existence prior to searching for ways to stop gambling.

Around 23% of older individuals aged 55 to 64 learned about the scheme from a gambling company, as opposed to 14% of the gamblers aged 18 to 24. Approximately 22% of the young people from this age group were informed about GAMSTOP by relatives or friends. In contrast, only 7% of the older excluded gamblers said they had learned about the scheme this way.

Number of Self-Exclusions in Other Regulated Markets

Many regulated markets have introduced self-exclusion schemes in an attempt to curb problem-gambling rates among their population. Sweden, Denmark, and Finland serve as prime examples, as all three countries have nationwide exclusion registers.

(Source: Spelpaus.se)

(Source: Spillemyndighedens.dk)

(Source: Veikkaus.fi)

Problem Gambling Incidence among Minors in the UK

Gambling participation rates among underage Brits are on the rise and the statistics are quite alarming, to say the least. According to a report published by the UKGC in 2022, roughly 0.9% of British minors between 11 and 16 years are classified as problem gamblers. Another 2.4% of the young people from this age group are thought to be at risk of developing gambling problems. This section provides more interesting insights into gambling participation rates among adolescents in the UK.

Recently Adopted Measures for Gambling Harm Reduction

The British watchdog has introduced various measures to minimise the harmful effects gambling has on minors, vulnerable individuals, and society as a whole. Below, we have compiled the most important regulatory changes that have come into effect in recent years.