The UK has been at the forefront of the global gambling industry for nearly two decades as it passed laws to regulate remote gaming as early as 2005. The country is currently home to the largest regulated online gambling market in the world, outstripping the United States, Australia, and France. UK-licensed online gambling operators posted combined gross gaming revenue (GGR) of £6.87 billion between April 2020 and March 2021, representing a 16.4% increase compared to the same period the following year.

Adequate regulations are among the biggest drivers of this growth. The country has adopted a multi-licensing regime that enables both private and public companies to obtain authorisation for the provision of remote gambling services on the local market. The increasing adoption of mobile devices, combined with improved internet connectivity and penetration, also propels the market forward.

Online casino games, sports betting, lotteries, and poker are all legal in the country and are regulated by the UK Gambling Commission (UKGC). Our analysts spent hours upon hours pouring over numbers to deliver this in-depth report. It presents the UK online gambling industry in numbers and provides detailed statistics about revenue, consumer behaviour, number of licensed operators, and more.

UK Online Gambling Market – Current Size and Growth Forecasts

Data published by the British gambling regulator indicates the remote casino, bingo, and sports betting sector experienced a decline last year. The gross gaming revenue (GGR) generated by the sector between April 2021 and March 2022 stood at £6.44 billion, representing a 6.2% decline compared to the same period the previous year.

Several factors negatively impact the industry’s growth, including increasing competition and overall online expenditure. The stricter regulatory rules introduced by the UKGC in recent years in an attempt to curb problem gambling also affect growth. Here is how the GGR of online operators in the UK has changed over the last seven years. The data is grouped by vertical, excluding online lotteries.

| GGR of UK Online Gambling Operators from 2015 to 2022 | ||||

|---|---|---|---|---|

| Period | Casino Games | Bingo Games | Sports Betting | Total per Year |

| April 2015 – March 2016 | £2.36 billion | £0.12 billion | £1.74 billion | £4.21 billion |

| April 2016 – March 2017 | £2.66 billion | £0.16 billion | £1.95 billion | £4.77 billion |

| April 2017 – March 2018 | £2.93 billion | £0.16 billion | £2.25 billion | £5.34 billion |

| April 2018 – March 2019 | £3.11 billion | £0.18 billion | £2.02 billion | £5.31 billion |

| April 2019 – March 2020 | £3.23 billion | £0.18 billion | £2.33 billion | £5.74 billion |

| April 2020 – March 2021 | £4.04 billion | £0.19 billion | £2.64 billion | £6.87 billion |

| April 2021 – March 2022 | £3.90 billion | £0.18 billion | £2.36 billion | £6.44 billion |

| Total per Vertical | £22.23 billion | £1.17 billion | £15.29 billion | £38.68 billion |

Source: UK Gambling Commission

Combined GGR from Online Casino Games (2015-2022)

Looking at the numbers above, we see casino games are the most profitable vertical from the perspective of online gambling operators licensed in the UK. GGR from casino games was consistently on the rise from 2015 to 2021, increasing by nearly 71.2% during this period. Revenue slumped by 3.5% the following year, dropping from £4.04 billion in 2021 to £3.90 billion in 2022.

Online Casino Games Ranked by GGR (April 2021 – March 2022)

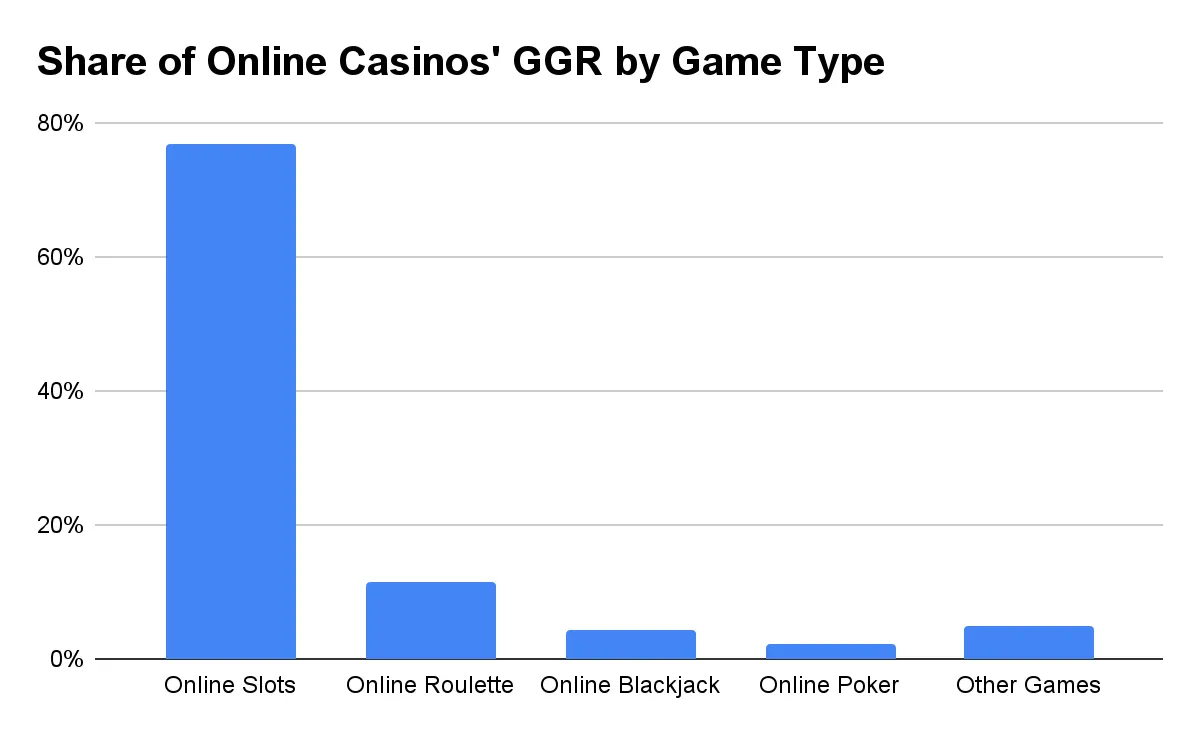

Slots accounted for the largest share of the revenue remote operators generated from online casino games between April 2021 and March 2022, followed by roulette, blackjack, peer-to-peer poker, and other games. Out of those, poker suffered the biggest year-over-year revenue decline as it generated £52.2 million less.

- Slot games: 77% of the GGR (up 2.3% from March 2021)

- Roulette games: 11.6% of the GGR (down 14.7% from 2021)

- Other games: 4.9% of the GGR (down 20.1% from 2021)

- Blackjack games: 4.3% of the GGR (down 15.1% from 2021)

- Peer-to-peer poker games: 2.2% of the GGR (down 36.8% from 2021)

Source: UK Gambling Commission

Combined GGR from Online Sports Betting (2015-2022)

Online sports betting was the second most profitable sector of the remote gambling industry, generating combined revenue of £15.29 billion from April 2015 to March 2022. Like online casino games, the sector witnessed steady albeit modest growth between 2015 and 2021 when GGR rose by 51.7%. Similarly, there was a downturn in 2022 when revenue dropped by 10.6% from £2.64 billion to £2.36 billion.

Online Sports Betting Activities Ranked by GGR (April 2021 – March 2022)

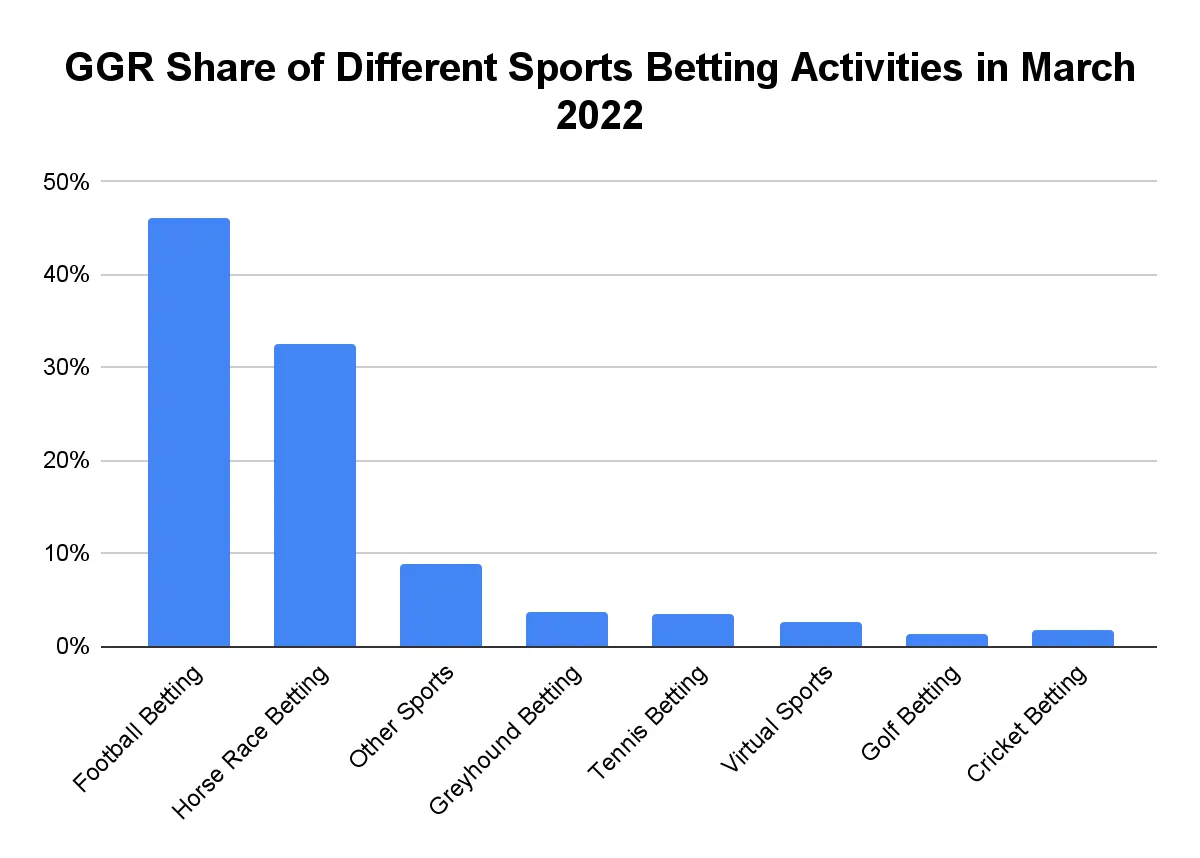

As is to be expected from a prominent football nation like the UK, football dominated the revenue from the sports betting vertical last year. This is unsurprising, considering that approximately 63% of the country’s residents describe themselves as football fans, according to Statista.

Despite the sport’s massive popularity, football betting generated £132.2 million less in revenue between April 2021 and March 2022, compared to the same period the previous year. Horse racing secured the second largest GGR share, while dog racing, tennis, cricket, golf, and virtual sports all trailed behind.

- Football betting: 46% of the GGR from sports betting (down 10.8% from March 2021)

- Horse race betting: 32.5% of the GGR (down 10.2% from 2021)

- Other sports: 8.9% of the GGR (down 21.8% from 2021)

- Greyhound betting: 3.6% of the GGR (up 7.5% from 2021)

- Tennis betting: 3.5% of the GGR (up 24.5% from 2021)

- Virtual sports betting: 2.6% of the GGR (down 40.3% from 2021)

- Golf betting: 1.2% of the GGR (up 30.7% from 2021)

- Cricket betting: 1.7% of the GGR (up 31.4% from 2021)

Source: UK Gambling Commission

GGR from Online Bingo (2015-2022)

Online bingo brought in the lowest profits during this period, generating a total of £1.17 billion in GGR between 2015 and 2022. The sector saw growth of 50% over the past seven years, with gross gaming revenue peaking during the period between April 2020 and March 2021. A slight decline took place in March 2022 as revenue from this vertical dwindled by 3%, from £189.1 million to £183.5 million year-over-year.

GGR Comparison with the Landbased Sector

The GGR of online gambling operators remained stable during the coronavirus pandemic, but the same cannot be said for the landbased sector whose revenue declined dramatically over the past several years.

By means of comparison, the brick-and-mortar industry brought in GGR of only £3.5 billion between April 2021 and March 2022. While this amount corresponds to a little over half of the revenue generated by the remote sector during the same period, landbased gambling still saw an impressive 110.5% increase, which we attribute to the easing of the coronavirus curbs last year. However, the sector is yet to recover to its pre-pandemic levels.

Market Growth Forecasts

Looking forward, the International Market Analysis Research and Consulting Group (IMARC Group) predicts the remote gambling market in the UK will continue to grow in the years to follow. According to the market research company, the size of the industry’s online segment will expand to 11 billion US dollars (£8.6 billion) by 2028, achieving a compound annual growth rate of 5.4% over the next five years.

How does the UK measure against other major online gambling markets?

The UK currently ranks as the world’s largest online gambling market in terms of GGR, followed by the United States and Australia. Forecasts by the IMARC Group suggest all three countries will see their online gambling markets grow over the next five years. Here are the forecasts for growth on a per-country basis.

Source: IMARC Group

UK Gambling Operators Statistics

While the remote sector has been exhibiting overall growth in recent years, there is a noteworthy decline in the number of gambling companies operating in the country. Market consolidation through mergers and acquisitions is one plausible explanation for this downward trend. More and more gambling businesses are starting to merge with each other in an attempt to capture a greater market share and in turn, boost their profitability.

Biggest Gambling Mergers and Acquisitions in the UK (2018-2023)

Number of Regulated Gambling Companies in the UK

The most recent data published by the UKGC shows a slight decline in the number of licensed gambling operators, which dropped from 2,819 in 2018 to 2,419 in 2022, reflecting a 14.2% decrease during this period. Here is how the number of regulated gambling businesses has fluctuated over the past five years.

- 2018: 2,819 licensed operators

- 2019: 2,690 licensed operators (down 4.6% from 2018)

- 2020: 2,581 licensed operators (down 4.1% from 2019)

- 2021: 2,441 licensed operators (down 15.3% from 2020)

- 2022: 2,419 licensed operators (down 0.9% from 2021)

Source: UK Gambling Commission

Licensed Gambling Businesses Grouped by Sector (2022)

Looking at data released by the UK gambling watchdog, we see that the lottery sector had the highest percentage of licensees in 2022, followed by remote casino, betting, and bingo, retail sports betting, arcades, and gaming machine technical suppliers. Check out the full breakdown below. As you shall see, only the arcades sector reported an increase in licensees, albeit a very modest one.

- Lottery licensees: 19% of all licensees

- Retail sports betting licensees: 17.9% (down 2.8% compared to March 2021)

- Remote casino, betting, and bingo (RCBB) licensees: 17.7% (down 1.3% compared to 2021)

- Arcade licensees: 15.6% (up 0.6% compared to 2021)

- Gaming machine technical (GMT) licensees: 13% (down 0.7% compared to 2021)

- Gambling software licensees: 9.3% (down 1.3% compared to 2021)

- Landbased bingo licensees: 4.7% (down 0.6% compared to 2021)

- Landbased casino licensees: 1.5% (no change from the previous period)

- External lottery manager (ELM) licensees: 1.3% (down 4.3% compared to 2021)

Source: UK Gambling Commission

Regulated Landbased Gambling Premises Ranked by Type

Landbased gambling venues suffered a 24% decrease from 2018 to 2022 as the number of premises in operation dropped from 11,069 to 8,408. The sector has been witnessing consistent decline over the last several years as you can see below. We attribute this significant downward trend to the coronavirus-induced shutdowns during the pandemic.

- 2018: 11,069 gambling premises

- 2019: 10,761 gambling premises (down 2.8% from 2018)

- 2020: 10,137 gambling premises (down 5.8% from 2019)

- 2021: 8,628 gambling premises (down 14.9% from 2020)

- 2022: 8,408 gambling premises (down 2.5% from 2021)

In March 2022, on-course and off-course sports betting premises accounted for the largest share of the regulated landbased market, followed by arcades, bingo parlours, and casinos.

- Sports betting shops: 74% (down 3.8% from March 2021)

- Arcades: 17.1% (down 8.8% from 2021)

- Bingo parlours: 7.2% (up 4.1% from 2021)

- Casinos: 1.7% (up 1,957% from 2021)

Source: UK Gambling Commission

Consumer Behaviour and Online Gambling Participation Rates in the UK

Various factors have contributed to the robust growth of the online gambling market in the UK over the past seven years, including increasing consumer purchasing power, improved internet penetration, the rising demand for this type of entertainment, and the advance in technologies.

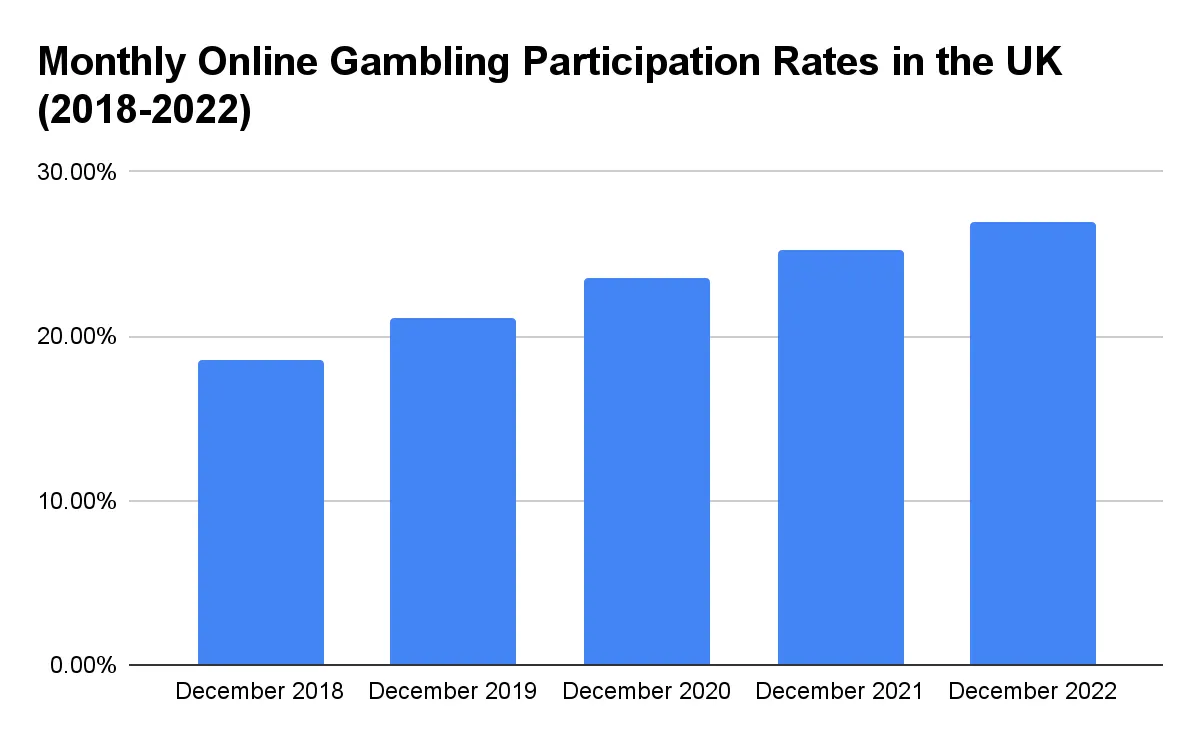

Additionally, British gamblers can have their peace of mind when betting online as the industry is incredibly well regulated, with various measures in place to protect consumers from unethical practices. Data sourced from the UKGC reveals nearly 27% of the adult population had participated in online gambling in the previous month as of December 2022. The graph below demonstrates how monthly gambling participation rates have changed over the past five years.

Monthly Online Gambling Participation Rates (2018-2022)

- December 2018 – 18.5% of the adult residents

- December 2019 – 21.1% of the adult residents

- December 2020 – 23.6% of the adult residents

- December 2021 – 25.3% of the adult residents

- December 2022 – 26.9% of the adult residents

Source: UK Gambling Commission

How frequently do Brits participate in gambling?

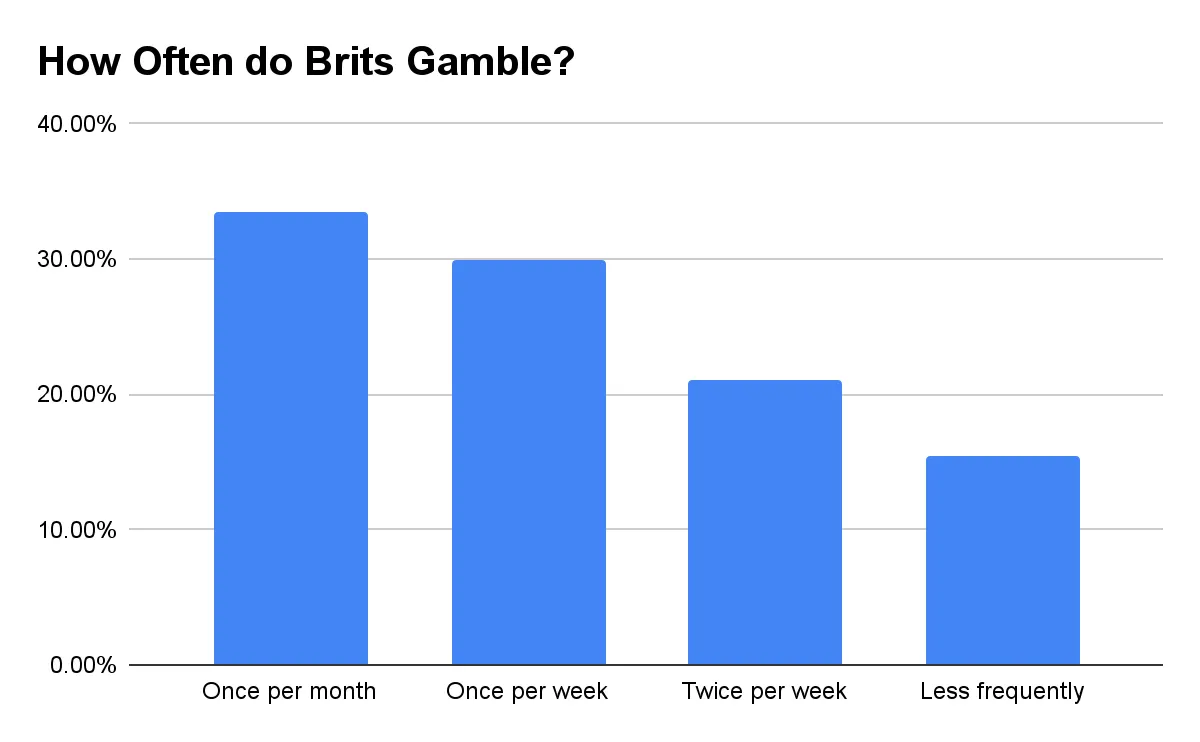

As for the overall frequency of gambling participation, nearly 34% of adult Brits admitted to having a flutter at least once per month in the year to September 2022. As many as 30% place wagers once per week, while another 21% do so at least twice per week. The percentage of infrequent gamblers who wagered less than once per month fluctuated around 16%.

Source: Yonder Consult/UK Gambling Commission

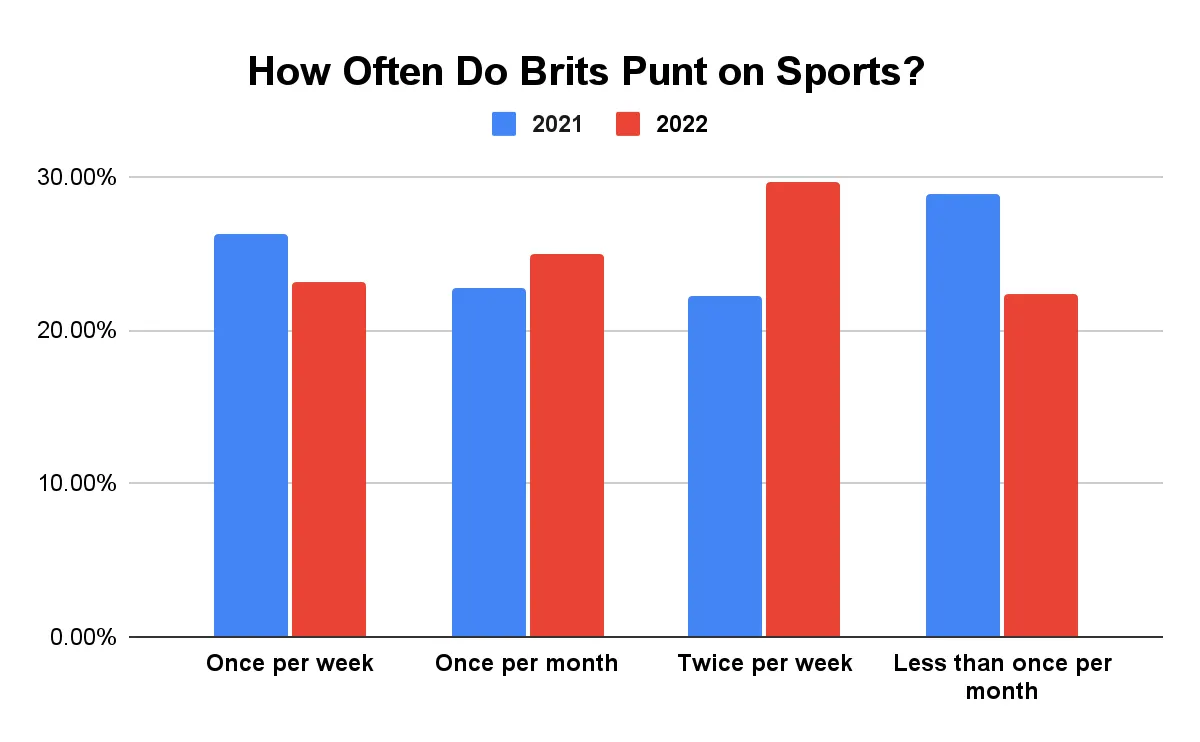

How often do British punters have a flutter on sports events?

Almost 30% of Brits had a flutter on horse races and other sports events at least twice a week in the year ending in September 2022. The percentage of those who gambled once per month stood at 25%, while those who fancied one punt per week fluctuated around 23%.

Source: Yonder Consulting/UK Gambling Commission

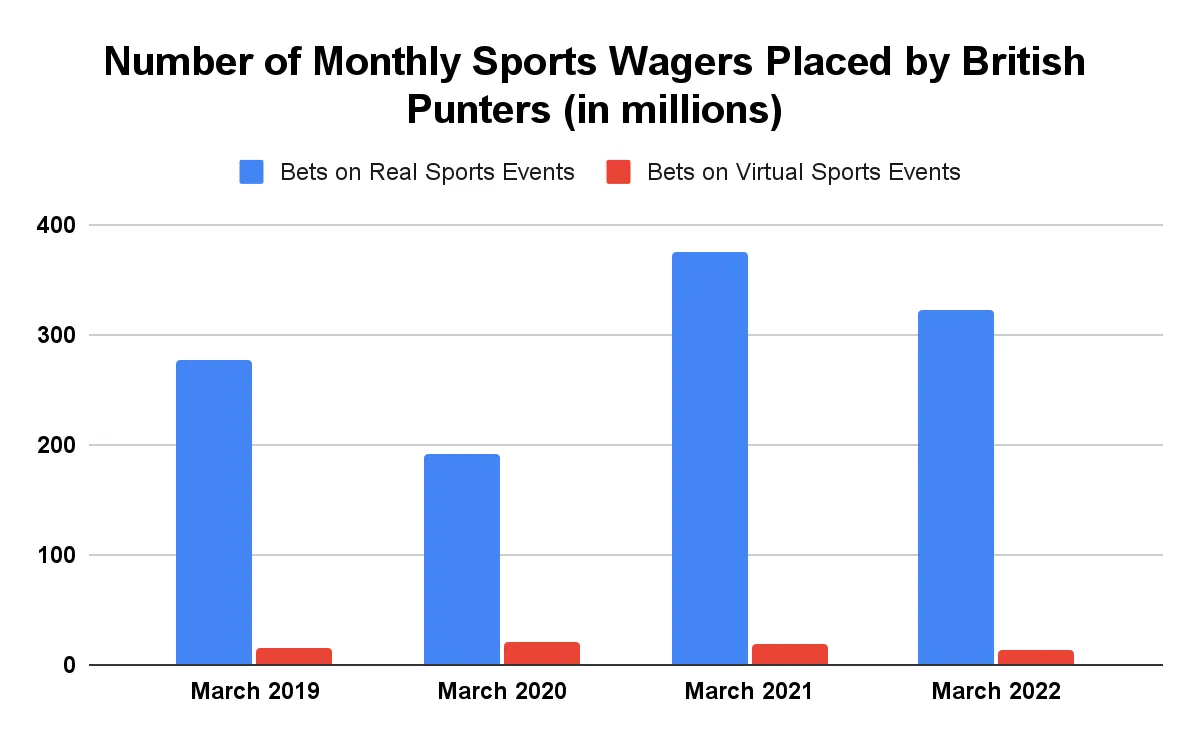

How many sports wagers do British punters place each month?

The UK accounted for approximately 23% of the sports wagering market on the Old Continent in 2021. France ranked as a close second with a 20% market share. In this vein, we decided it would be interesting to track how many sports bets British punters place per month. To this end, we looked at official data published by the UK watchdog for the period between March 2019 and March 2022.

Monthly wagering on real sports events reached its peak in March 2021 when the country’s residents made roughly 375.2 million punts within a 30-day period. The number went down by 13.9% in the same month the following year when it dwindled to 323.2 million wagers on real events. Betting activities were at their lowest in April 2020 (78.1 million wagers) when the coronavirus pandemic broke out and disrupted live sporting events, many of which got cancelled or delayed.

This led to an increase in virtual sports betting which peaked in April 2020 with 28.5 million placed wagers. Betting on virtual events gradually went back to its pre-pandemic rates as real sports competitions started to resume in 2021 and 2022.

Source: UK Gambling Commission

How many active online sports bettors are there in the UK?

It appears many Britons fancy a flutter, which hardly comes as a shock considering some of the most successful sports clubs and athletes in history have emerged from the UK. Manchester United, Arsenal, Andy Murray, Lewis Hamilton, and Rory McIlroy all hail from the Land of the Rose.

Given this star-studded lineup of talented athletes, we find it unsurprising that the country had 6.38 million active punters who wagered on real sports as of March 2022. By comparison, only 230,000 people actively placed bets on virtual events during this period. Here is how the numbers have fluctuated over the past several years.

- 5.2 million real-sports punters

- 0.21 million virtual-sports punters

- 4.64 million real-sports punters (a 10.8% decrease YoY)

- 0.39 million virtual-sports punters (an 85.7% increase YoY)

- 6.02 million real-sport punters (a 29.7% increase YoY)

- 0.27 million virtual-sports punters (a 30.8% decrease YoY)

- 6.38 million real-sports punters (a 6.0% increase YoY)

- 0.23 million virtual-sports punters (a 14.8% decrease YoY)

Source: UK Gambling Commission

Number of active accounts at UKGC-licensed online gambling operators

The number of online gamblers with active real-money accounts at UK-licensed operators almost reached 32 million as of March 2022. The country’s population stood at 67.5 million at the time, which means a whopping 47.2% of all residents had active accounts assuming that each person had registered only once.

The latter peaked in March 2018 when they numbered approximately 34.2 million, and were at their lowest in March 2011 when local gamblers held almost 15 million active accounts with regulated remote gambling businesses. Below, you can trace the changes across this vertical from April 2008 to March 2022.

- April 2008 – March 2009 – 16.14 million

- April 2009 – March 2010 – 16.57 million

- April 2010 – March 2011 – 14.92 million

- April 2011 – March 2012 – 15.18 million

- April 2012 – March 2013 – 16.53 million

- April 2013 – March 2014 – 16.99 million

- April 2014 – March 2015 – 21.78 million

- April 2015 – March 2016 – 23.05 million

- April 2016 – March 2017 – 30.52 million

- April 2017 – March 2018 – 34.22 million

- April 2018 – March 2019 – 30.59 million

- April 2019 – March 2020 – 30.12 million

- April 2020 – March 2021 – 29.80 million

- April 2021 – March 2022 – 31.88 million

Source: UK Gambling Commission

New registrations at UKGC-licensed online operators (2008-2022)

Data pulled from the UKGC reveals there was a slight decline in the number of new registrations over the past couple of years. Newly created accounts at regulated online gambling operators shrank by 1% during the period between April 2021 and March 2022 when their number was estimated at 32.65 million. By comparison, 32.98 million accounts were created during the same period a year earlier.

Nonetheless, the overall outlook is positive as we can observe a clearly distinguishable upward trend in the number of newly registered accounts compared to pre-pandemic levels. Brits created 29.92 million accounts between April 2019 and March 2020, which makes for a 9.1% increase in new registrations. As you can see below, the overall number of newly registered accounts has risen by 673.7% over the last 13 years.

- April 2008 – March 2009: 4.22 million new registrations

- April 2009 – March 2010: 3.95 million

- April 2010 – March 2011: 3.31 million

- April 2011 – March 2012: 3.83 million

- April 2012 – March 2013: 4.62 million

- April 2013 – March 2014: 8.97 million

- April 2015 – March 2016: 23.94 million

- April 2016 – March 2017: 32.28 million

- April 2017 – March 2018: 32.33 million

- April 2018 – March 2019: 33.28 million

- April 2019 – March 2020: 29.92 million

- April 2020 – March 2021: 32.98 million

- April 2021 – March 2022: 32.65 million (a 9.1% increase from April 2019 – March 2020)

Source: UK Gambling Commission

How much money do Brits have in their online gambling accounts?

The combined amount of money British gamblers had in their online accounts was estimated at £910.5 million between April 2021 and March 2022, which is approximately 1.8% less compared to the same period a year earlier when they had £893.8 million.

With this insignificant decline in mind, we should mention this number represents the highest amount local gamblers have stored in their real-money balances in the past few years. Looking at the data below, we see online gambling balances have surged by almost 50% since the 2015-2016 reporting period.

- April 2015 – March 2016: £607.38 million

- April 2016 – March 2017: £880.05 million

- April 2017 – March 2018: £803.16 million

- April 2018 – March 2019: £902.27 million

- April 2019 – March 2020: £692.61 million

- April 2020 – March 2021: £893.76 million

- April 2021 – March 2022: £910.5 million

Source: UK Gambling Commission

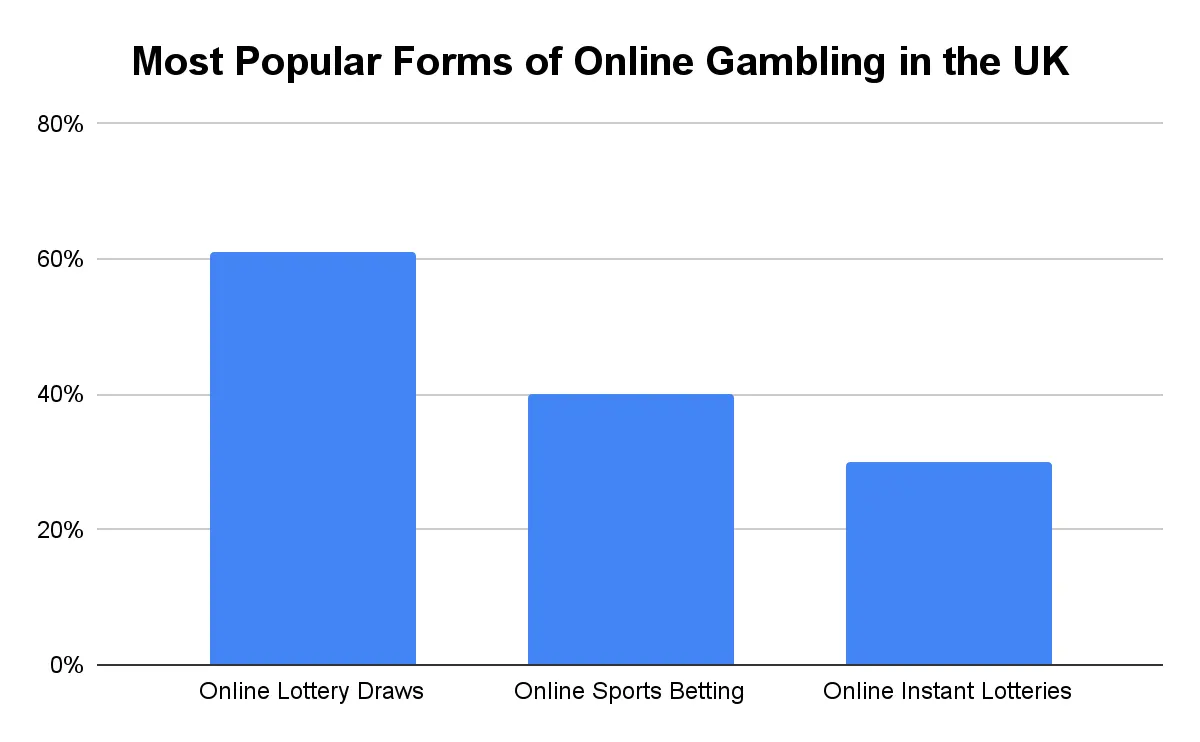

Most popular forms of online gambling according to Brits

A survey conducted by the market research website YouGov reveals that draw-based lotteries are far and away at the top of the rankings where popularity is concerned. Approximately 61% of the survey participants said they believe lottery draws are the most popular form of online gambling in September 2021. Online sports betting ranked second with 40% of the respondents naming it as the most popular, followed by instant lotteries with 30%.

Source: YouGov

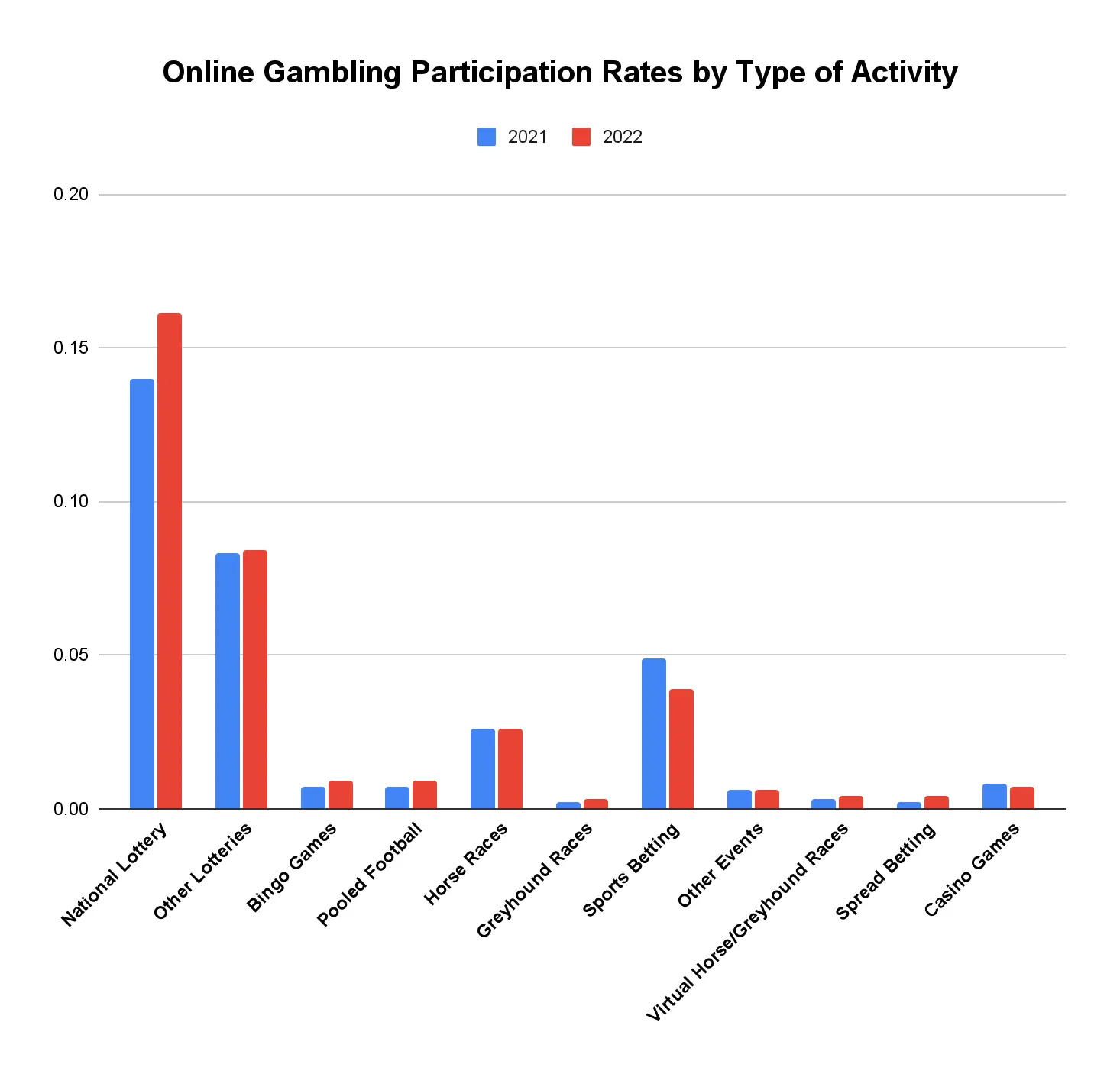

Online Gambling Participation Rates in the UK Ranked by Type of Activity

National lottery draws surpassed all other online gambling activities in terms of participation rates in the year to September 2022. A Yonder Consulting telephone poll conducted on behalf of the UKGC revealed as many as 24.5% of Brits participated in one form of online lottery or another in the last four weeks prior to the survey. Overall online lottery participation rates were up by around two percentage points compared to the previous year when 22.3% of Brits admitted to taking part in this activity.

Online sports betting earned the second spot with 3.9% and was trailed by horse race betting with 2.6%. Participation rates were low for all other forms of gambling during this period, with none of them surpassing the one per cent mark. The results of the survey were relatively consistent with those for the year to September 2021 as shown below.

Source: Yonder Consulting/UKGC

Online Gambling Participation Rates among Different Age Groups in the UK

Online gambling appears to be most prevalent among Brits aged 45 to 54 years old as revealed by another survey commissioned by the UKGC. As many as 35% of the people from this age group said they have gambled over the internet at least once over the course of the last four weeks before participating in the survey, which reflects the rates for the year to September 2021. According to the survey results, online gambling was the least prevalent during this period among residents aged 65 or older (17.3%).

| Online Gambling Participation by Age Group | ||

|---|---|---|

| Age Group | Year to September 2022 | Year to September 2021 |

| 16 to 24 | 18.90% | 15.80% |

| 25 to 34 | 28.30% | 25.20% |

| 35 to 44 | 32.20% | 28.80% |

| 45 to 54 | 35.00% | 32.80% |

| 55 to 64 | 31.20% | 28.00% |

| 65 years old and above | 17.30% | 18.80% |

Source: Yonder Consulting/UKGC

Who gambles more – British men or British women?

The same Yonder Consulting survey established that British men have a greater propensity to gamble compared to the representatives of the fairer sex. In the year to September 2022, only 24.5% of females said they had gambled in the past four weeks compared to 29.5% of the males. Various socioeconomic factors could have contributed to the prevalence of gambling among men but this trend has been consistently observed from 2018 onwards as shown below. All in all, participation among men has risen by almost eight percentage points between 2018 and 2022.

| Online Gambling Participation Trends in the UK by Gender (2018 – 2022) | ||

|---|---|---|

| Period | Male Participation | Female Participation |

| Year to September 2018 | 21.60% | 15.30% |

| Year to September 2019 | 25.10% | 16.20% |

| Year to September 2020 | 25.60% | 19.70% |

| Year to September 2021 | 28.10% | 22.10% |

| Year to September 2022 | 29.50% | 24.50% |

Source: Yonder Consulting/UKGC

Why do Brits gamble?

Recreation is the primary motivation for online gambling among Brits. As much as 48% of men claim they gamble because it is fun compared to 40% of women who cited this as their main reason for gambling participation. Other leading reasons for gambling listed by adults of both genders include fantasising about winning, hoping to land a huge landfall, and enhancing one’s experience when watching sporting events. Being part of an online community is the weirdest and least widespread motivation for gambling among residents. Below, you can check out the full breakdown of the top 10 reasons why Brits gamble.

- Because it is fun: 48% of men, 40% of women

- Daydreaming about landing a win: 21% of men, 28% of women

- Hoping to have a windfall: 19% of men, 17% of women

- Spicing up my experience while watching sports: 20% of men (20%), 7% of women

- Having something to discuss with with peers: 11% of men, 6% of women

- It is a matter of routine: 10% of men, 6% of women

- To showcase skill: 6% of men, 1% of women

- Not to miss out: 3% of men, 4% of women

- It is a good way to earn money: 4% of men, 1% of women

- To become part of an online community: 2% of men, 1% of women

Source: Statista

What does the British public think about gambling?

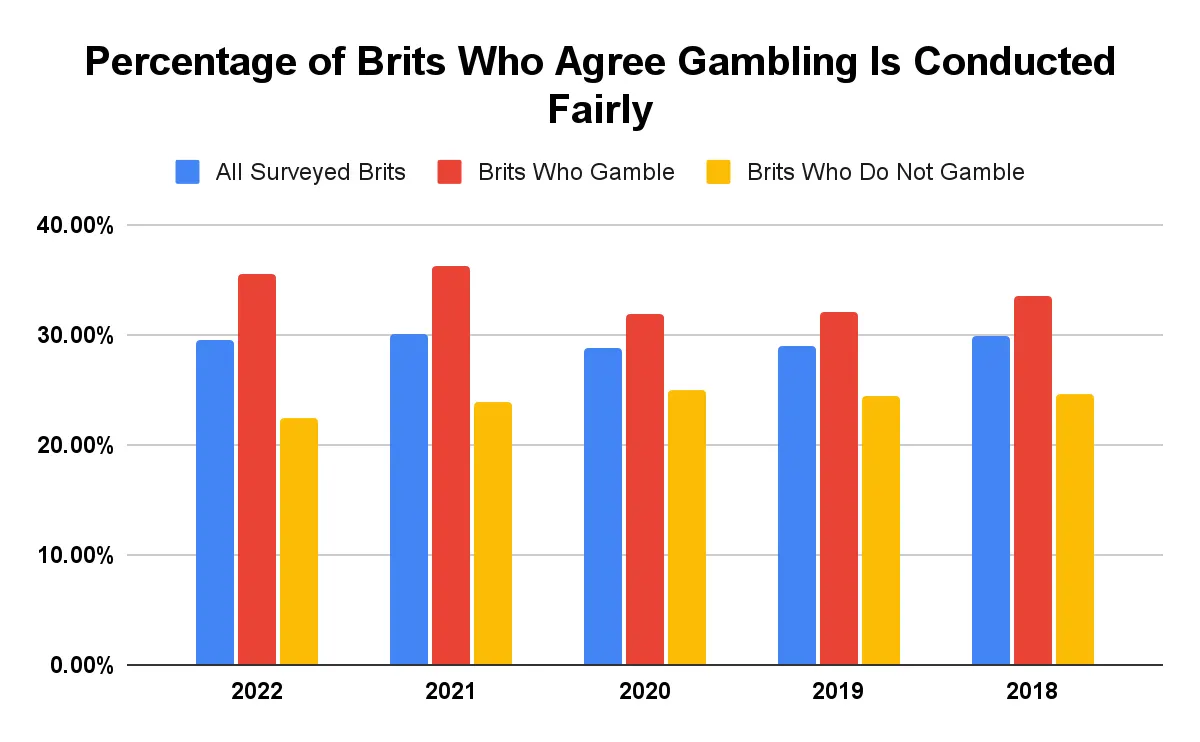

Another Yonder Consulting telephone survey commissioned by the UK watchdog puts on view the public perceptions of gambling in the year to December 2022. One of the questions asked was whether gambling was conducted in a fair manner. As many as 29.5% of the survey participants replied affirmatively and agreed with the statement that gambling operators can be trusted.

Gamblers (35.5%) are more prone to share this opinion compared to those who do not participate in any betting activities (22.5%). As shown below, these responses are statistically stable compared to the results from the previous years.

Source: Yonder Consulting/UK Gambling Commission

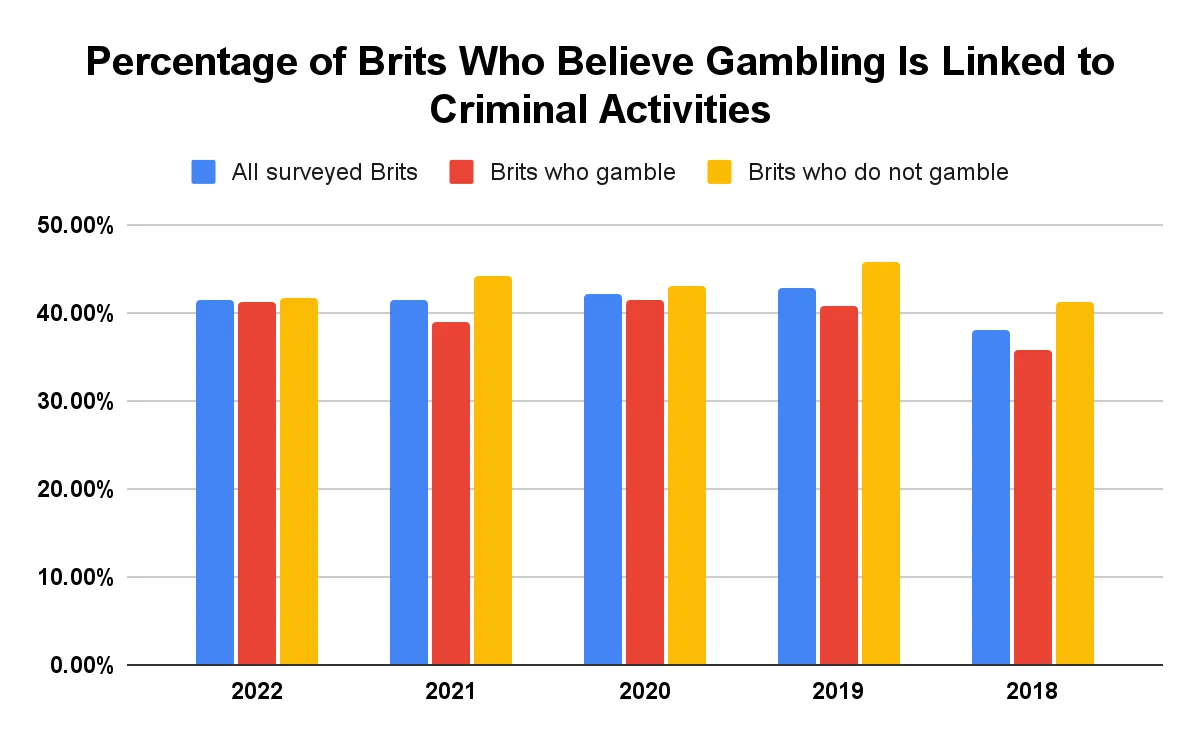

The gambling industry in the UK is very well regulated but this does not prevent 41.4% of Brits from thinking gambling is linked to illegal or criminal activities. There is a slight increase of 3.5 percentage points compared to the year to December 2018 when Yonder Consulting conducted a similar survey on behalf of the UKGC. The number of gamblers (41.2%) and non-gamblers (41.6%) who share this opinion is nearly identical, with a minuscule difference of less than half a percentage point.

Source: Yonder Consulting/UK Gambling Commission

More Public Opinions about Gambling

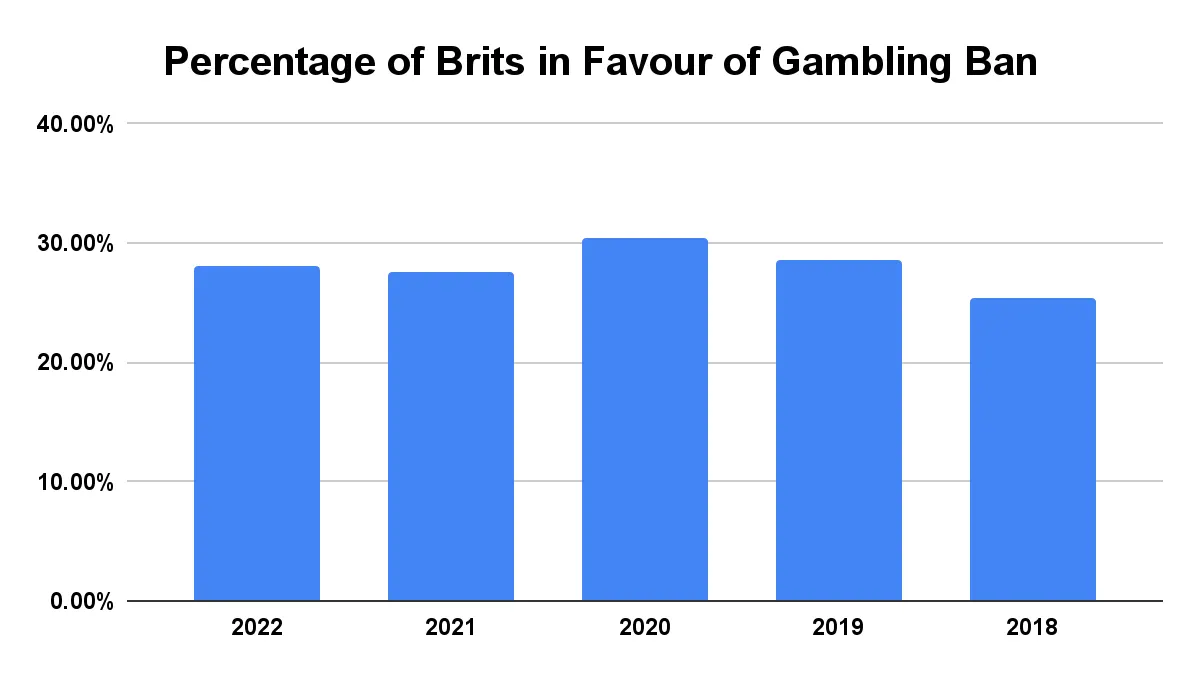

Yonder Consulting asked several additional questions presented in the form of positive and negative statements. Survey participants had to say whether they agree or disagree with each of these statements. The results revealed a whopping 78.9% of Brits believe gambling is widespread and there are way too many opportunities to participate in it.

Approximately 71% consider gambling a threat to family life, while 62.3% think adults should be able to place bets whenever they feel like it. Around 28% of Brits favour the idea of imposing an outright ban on gambling in the country. Only 12.2% of Brits share the opinion gambling is overall good for society.

Source: Yonder Consulting/UK Gambling Commission

How Prevalent Is Gambling among the British Youth?

In 2022, the leading global market research company Ipsos was commissioned by the UKGC to carry out a survey about gambling participation among the British youth and the results are more than disconcerting. The study revealed that roughly half of the young people in the country aged 11 to 16 have participated in gambling in one form or another. Approximately 31% described their involvement in gambling as ‘active’. For clarification, active involvement means the youngsters have gambled with their own pocket or birthday money.

Interestingly, gambling is more prevalent among females (51%) from this age group compared to young males (49%). As concerning as it sounds, 12-year-olds are the biggest gamblers, with 53% of them admitting to placing bets over the past year.

Breakdown of minors with experience of gambling, by age

- 11-year-olds: 45% (33% with active involvement)

- 12-year-olds: 53% (31% with active involvement)

- 13-year-olds: 48% (31% with active involvement)

- 14-year-olds: 52% (33% with active involvement)

- 15-year-olds: 48% (30% with active involvement)

- 16-year-olds: 47% (30% with active involvement)

Another interesting finding of Ipsos is that more minors (38%) experienced or were exposed to regulated forms of gambling licensed by the UK Gambling Commission. By contrast, only 23% of young people had access to unregulated gambling that lacks the seal of approval of the British watchdog.

Similar tendencies can be observed among youngsters who were actively involved in gambling. In 2022, as much as 30% of the minors from this age group spent their own money with regulated gambling businesses compared to 18% who participated in unregulated gambling.

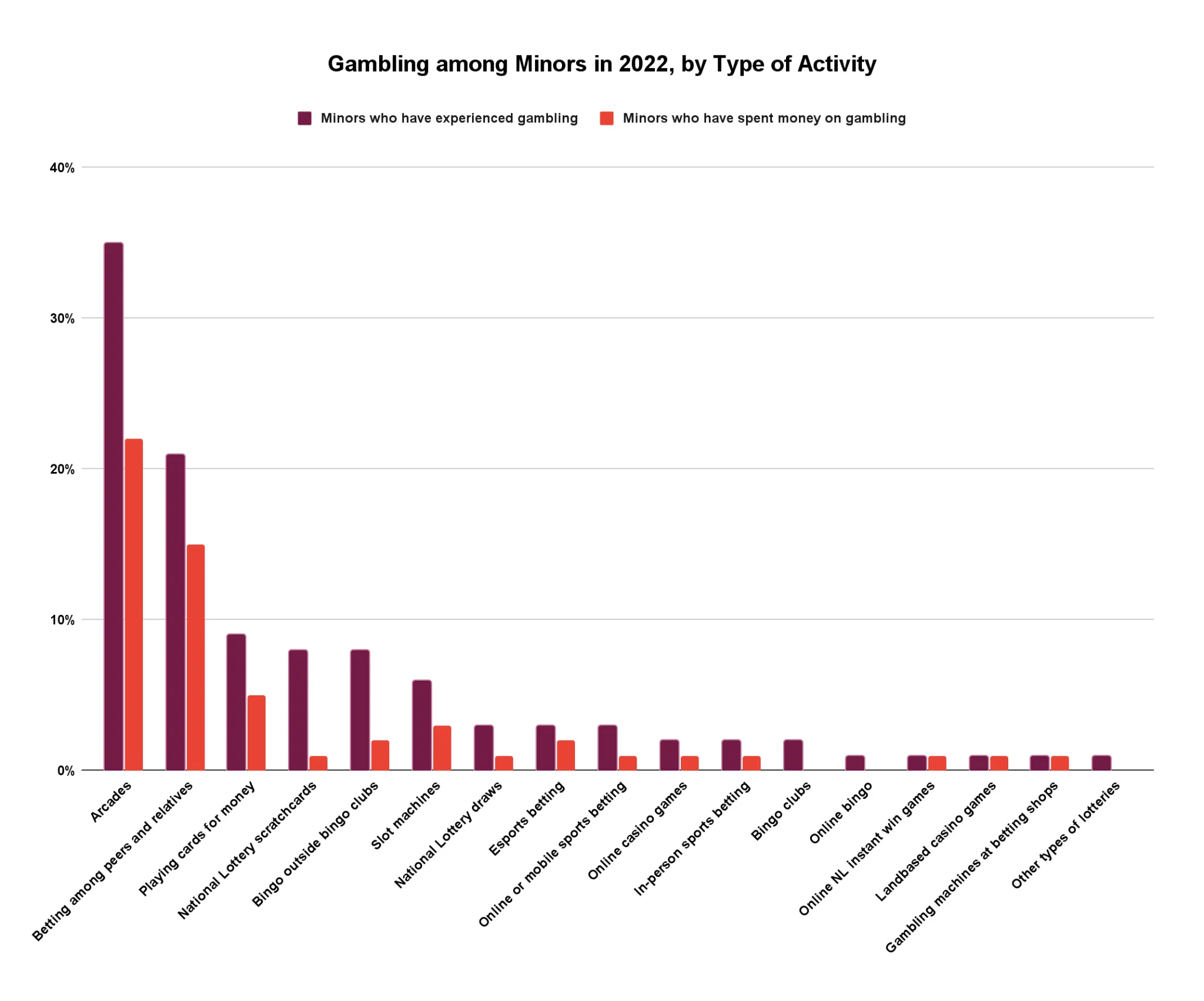

Breakdown of gambling among minors by type of activity

Arcades are the most prevalent form of gambling among the British youth, with 22% of minors spending their money on such gaming machines. Betting between peers or relatives (15%), playing cards for money (5%), slot machines (3%), and bingo (2%) also made it to the top 5 list.

Source: Ipsos/UK Gambling Commission

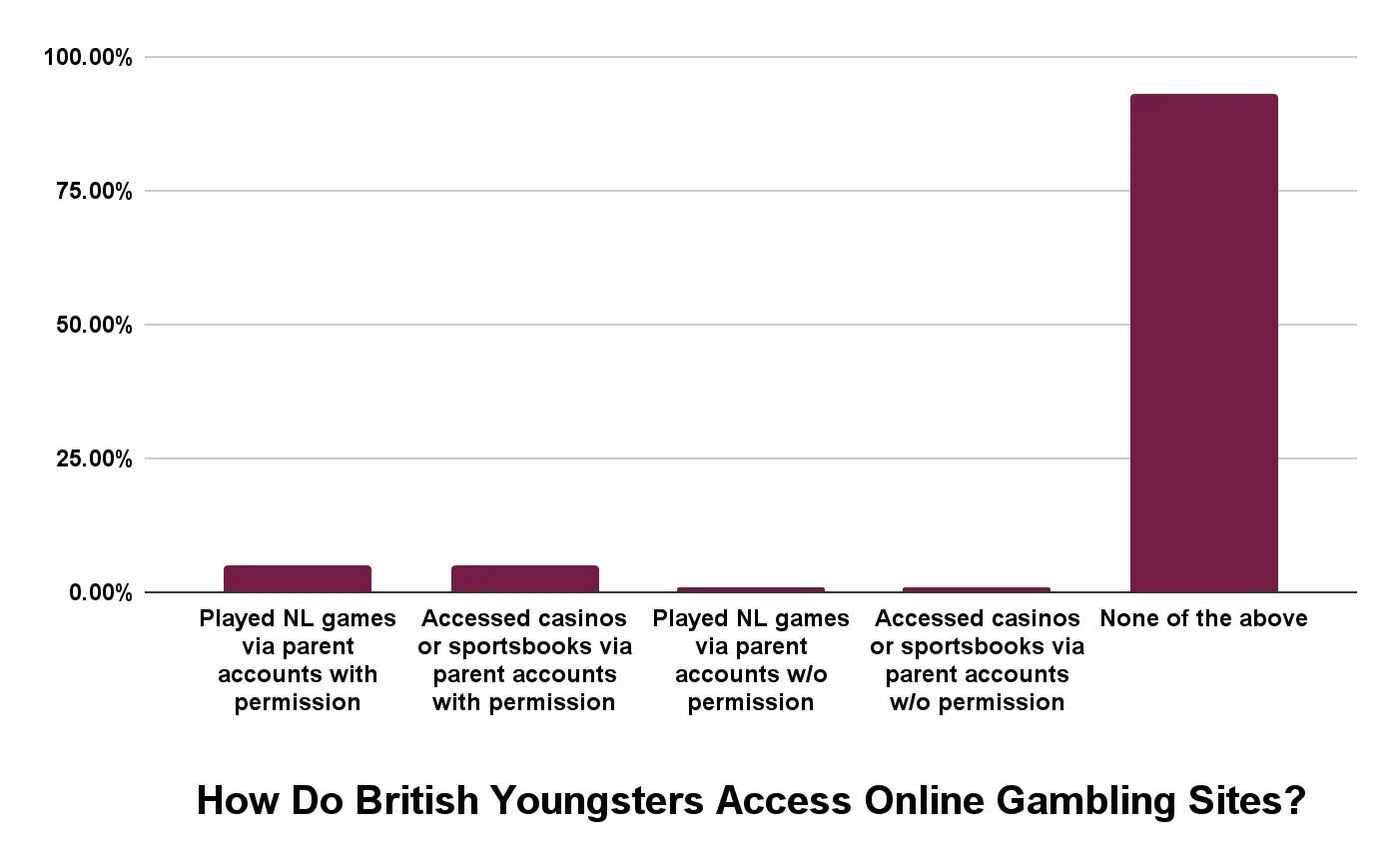

How do minors access online gambling sites?

As you saw earlier, a combined 10% of the minors who admitted to participating in gambling did so over the internet. What’s outrageous is that 5% of the youngsters who gambled online used their parents’ accounts with their permission to punt on sports or play casino games, while another 5% gained access to National Lottery games this way. Only 1% of the minors said they had accessed the National Lottery via parental accounts without permission. Another 1% did the same with online sportsbooks and gambling websites.

Source: Ipsos/UK Gambling Commission

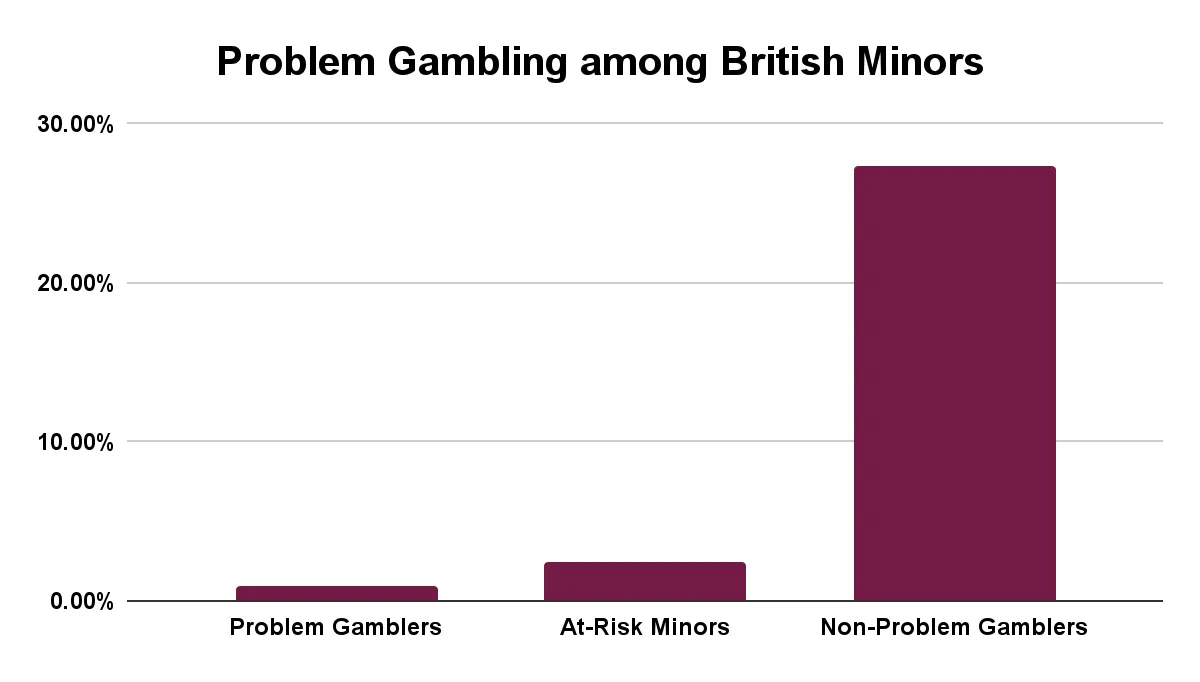

Prevalence of problem gamblers among minors

According to market research company Ipsos, nearly 1% of the British youngsters from the 11-to-16 age group were classified as problem gamblers in 2022. As much as 2.4% were at risk of developing a problematic relationship with gambling, while another 27.3% were categorised as non-problem gamblers.

Source: Ipsos/UK Gambling Commission

Reasons for active gambling among British minors

- For recreation: 78% of youngsters

- Because there is a likelihood to win: 36% of youngsters

- Out of boredom: 35% of youngsters

- Because of the games’ simplicity: 34% of youngsters

- Out of the desire to win money: 32% of youngsters

- Because of the excitement: 24% of youngsters

- Because there is a likelihood to land a jackpot: 24% of youngsters

- Because of the risk involved: 23% of youngsters

- As a means of cheering up: 16% of youngsters

- Because gambling seems cool: 13% of youngsters

- Due to parent example: 10% of youngsters

- Because the money goes to charities: 10% of youngsters

How does gambling affect the lives of the British youth?

According to the data collected by Ipsos, gambling had no significant impact on the quality of sleep of most minors who placed bets with their own money. Around 4% experienced sleep deprivation as a result of either going to bed late due to gambling (2%) or because they were anxious about participating in betting activities (2%).

As for the impact on their spending, 12% said gambling had enabled them to buy something they wanted or needed. Only 5% claimed their betting had prevented them from buying something they wanted. Another concerning finding is that 1 in 20 minors (3%) say their involvement in gambling affected their schoolwork negatively, making it hard for them to focus on homework and studying.

Approximately 28%, or one in three minors, have seen their relatives or parents participate in gambling as opposed to 60% who have not. Around 7% of the youngsters from this category claimed their parents’ gambling led to more arguments at home.

Thankfully, only 2% indicated that gambling had an adverse effect on their families’ purchasing power, preventing them from having enough to eat. It was the opposite for around one in ten youngsters (11%) who said gambling helped their family members pay for otherwise unaffordable recreational activities like vacations or club visits.

Source: Ipsos/UK Gambling Commission

Online Gambling Brands in the UK Ranked by Popularity and Fame

Market research company YouGov launched a poll among UK residents to determine which are the most popular and well-known gambling brands in the country. Poll participants’ votes were based on two parameters, fame and popularity. Popularity measures how well-liked the brands are, while fame indicates whether respondents have heard about them or not.

Top 10 Gambling Brands in the UK Ranked by Popularity (Q2 2023)

Looking at the poll results, we see the National Lottery was the most popular gambling brand among UK residents during the second quarter of 2023. Approximately 53% of Brits have a positive opinion of the National Lottery (NL) compared to 13% who dislike it and 33% who are impartial. The NL is more popular among women than men. Where birth cohorts are concerned, millennials appear to have a more favourable opinion about the national lottery operator as opposed to baby boomers and those from the Generation X group.

EuroMillions ranks second with 44% of Brits liking it, followed by the People’s Postcode Lottery, which has raised over £1.1 billion for charities since it launched in 2005. Other gambling companies that made the cut include William Hill, Mecca Bingo, Tombola, Gala Bingo, and Paddy Power. Browse the ranking below to see all gambling brands that made it to the top 10 list.

- Popularity breakdown by gender: 57% of women, 49% of women

- Popularity breakdown by age: 62% of millennials, 50% of baby boomers, 49% of Gen X

- Popularity breakdown by party affiliation: 55% of Labourists, 49% of Liberal Democrats, 55% of Conservatives

- Year-over-year popularity change: down 4 percentage points from 57% in Q2 2022.

- Popularity breakdown by gender: 45% of women, 43% of men

- Popularity breakdown by age: 47% of millennials, 36% of baby boomers, 44% of Gen X

- Popularity breakdown by party affiliation: 44% of Labourists, 39% of Conservatives

- Year-over-year popularity change: down 4 percentage points from 48%

- Popularity breakdown by gender: 48% of women, 30% of men

- Popularity breakdown by age: 38% of millennials, 41% of baby boomers, 36% of Gen X

- Popularity breakdown by party affiliation: 39% of Conservatives, 42% of Labourists, 34% of Liberal Democrats

- Year-over-year popularity change: down 2 percentage points from 36%

- Popularity breakdown by gender: 39% of women, 29% of men

- Popularity breakdown by age: 42% of millennials, 34% of baby boomers, 30% of Gen X

- Popularity breakdown by party affiliation: 35% of Conservatives, 41% of Labourists, 30% of Liberal Democrats

- Year-over-year popularity change: no change from Q2 2022

- Popularity breakdown by gender: 27% of women, 30% of men

- Popularity breakdown by age: 37% of millennials, 12% of baby boomers, 31% of Gen X

- Popularity breakdown by party affiliation: 30% of Labourists, 27% of Conservatives

- Year-over-year popularity change: up 2 percentage points from 27%

- Popularity breakdown by gender: 22% of women, 33% of men

- Popularity breakdown by age: 33% of millennials, 14% of baby boomers, 30% of Gen X

- Popularity breakdown by party affiliation: 25% of Conservatives, 29% of Labourists, 42% of Liberal Democrats

- Year-over-year popularity change: down 3 percentage points from 24%

- Popularity breakdown by gender: 23% of women, 29% of men

- Popularity breakdown by age: 37% of millennials, 21% of baby boomers, 29% of Gen X

- Popularity breakdown by party affiliation: 24% of Conservatives, 23% of Labourists, 32% of Liberal Democrats

- Year-over-year popularity change: up 6 percentage points from 21%

- Popularity breakdown by gender: 17% of women, 34% of men

- Popularity breakdown by age: 34% of millennials, 17% of baby boomers, 24% of Gen X

- Popularity breakdown by party affiliation: 26% of Conservatives, 23% of Labourists, 27% of Liberal Democrats

- Year-over-year popularity change: up 8 percentage points from 18%

- Popularity breakdown by gender: 23% of women, 26% of men

- Popularity breakdown by age: 49% of millennials, 10% of baby boomers, 19% of Gen X

- Popularity breakdown by party affiliation: 20% of Conservatives, 24% of Labourists, 19% of Liberal Democrats

- Year-over-year popularity change: down 2 percentage points from 27%

- Popularity breakdown by gender: 21% of women, 26% of men

- Popularity breakdown by age: 36% of millennials, 17% of baby boomers, 21% of Gen X

- Popularity breakdown by party affiliation: 23% of Conservatives, 28% of Labourists, 35% of Liberal Democrats

- Year-over-year popularity change: up 4 percentage points from 19%

Source: YouGov

Top 10 Gambling Brands in the UK Ranked by Fame (Q2 2023)

The ‘fame’ parameter reflects what percentage of the British population has heard of one gambling brand or another. It is perhaps unsurprising that the Camelot-operated National Lottery surpasses all other betting brands in terms of exposure, with a whopping 98% of all Brits being aware of its existence as of Q2 2023.

Entain’s Ladbrokes, one of the most prominent names on the British high street, tied with EuroMillions. Around 97% of the country’s residents are familiar with the name of either brand. William Hill and the People’s Postcode Lottery ranked fourth and fifth with 95% and 94%, respectively. Here is the complete list of the ten most recognized gambling and betting brands in the UK, according to YouGov polls.

- Fame breakdown by gender: known by 97% of women and 98% of men

- Fame breakdown by age: known by 96% of millennials, 100% of baby boomers, and 97% of Gen X

- Fame breakdown by party affiliation: known by 99% of Conservatives, 99% of Labourists, and 99% of Liberal Democrats

- Year-over-year change in fame: down 1 percentage point from 99% in Q2 2022

- Fame breakdown by gender: known by 96% of women and 99% of men

- Fame breakdown by age: known by 95% of millennials, 99% of baby boomers, and 99% of Gen X

- Fame breakdown by party affiliation: 99% of Conservatives, 99% of Liberal Democrats, and 98% of Labourists

- Year-over-year change in fame: up 4 percentage points from 93%

- Fame breakdown by gender: known by 97% of women and 96% of men

- Fame breakdown by age: known by 95% of millennials, 98% of baby boomers, and 100% of Gen X

- Fame breakdown by party affiliation: 94% of Labourists and 94% of Conservatives

- Year-over-year change in fame: no change from Q2 2022

- Fame breakdown by gender: known by 96% of women and 93% of men

- Fame breakdown by age: known by 90% of millennials, 98% of baby boomers, 98% of Gen X

- Fame breakdown by party affiliation: 93% of Conservatives, 98% of Labour, 98% of Liberal Democrats

- Year-over-year change in fame: no change from Q2 2022

- Fame breakdown by gender: known by 93% of men and 95% of women

- Fame breakdown by age: known by 90% of millennials, 97% of baby boomers, and 99% of Gen X

- Fame breakdown by party affiliation: 94% of Liberal Democrats, 98% of Labourists, and 93% of Conservatives

- Year-over-year change in fame: up 2 percentage points from 92%

- Fame breakdown by gender: insufficient data

- Fame breakdown by age: insufficient data

- Fame breakdown by party affiliation: insufficient data

- Year-over-year change in fame: up 4 percentage points from 87%

- Fame breakdown by gender: known by 91% of men and 89% of women

- Fame breakdown by age: known by 93% of millennials, 93% of Gen X, and 96% of baby boomers

- Fame breakdown by party affiliation: 89% of Conservatives, 93% of Labourists, 93% of Liberal Democrats

- Year-over-year change in fame: up 5 percentage points from 85%

- Fame breakdown by gender: known by 91% of men and 88% of women

- Fame breakdown by age: known by 94% of millennials, 95% of baby boomers, and 90% of Gen X

- Fame breakdown by party affiliation: 99% of Liberal Democrats, 92% of Conservatives, and 92% of Labourists

- Year-over-year change in fame: no change compared to Q2 2022

- Fame breakdown by gender: known by 91% of men and 86% of women

- Fame breakdown by age: known by 93% of baby boomers, 89% of millennials, and 88% of Gen X

- Fame breakdown by party affiliation: 93% of Liberal Democrats, 89% of Conservatives, and 88% of Labourists

- Year-over-year change in fame: down 1 percentage point from 89%

- Fame breakdown by gender: known by 94% of men and 78% of women

- Fame breakdown by age: known by 94% of Gen X, 88% of millennials, and 85% of baby boomers

- Fame breakdown by party affiliation: 90% of Labourists, 89% of Conservatives, and 87% of Liberal Democrats

- Year-over-year change in fame: no change compared to Q2 2022

Online Gambling Operators in the UK Ranked by Market Cap

Using data we pulled from Google Finance, we attempted to rank the biggest online gambling operators licensed to service Brits based on market cap. Market capitalisation is an important metric since it measures the overall value of a publicly traded company’s outstanding stocks. Market cap is indicative of a company’s size and may be used to assess its overall financial performance. Here are the five gambling companies that came on top in July 2023.

- Established in: 2016

- Based in: Dublin, Ireland

- Number of employees: 16,813 people

- Established in: 2014

- Based in: Isle of Man

- Number of employees: 21,226 people

- Established in: 1997

- Based in: Malta

- Number of employees: 2,055 people

- Established in: 2000

- Based in: England

- Number of employees: 3,900 people

- Established in: 1997

- Based in: Gibraltar

- Number of employees: 1,413 people